April 2025

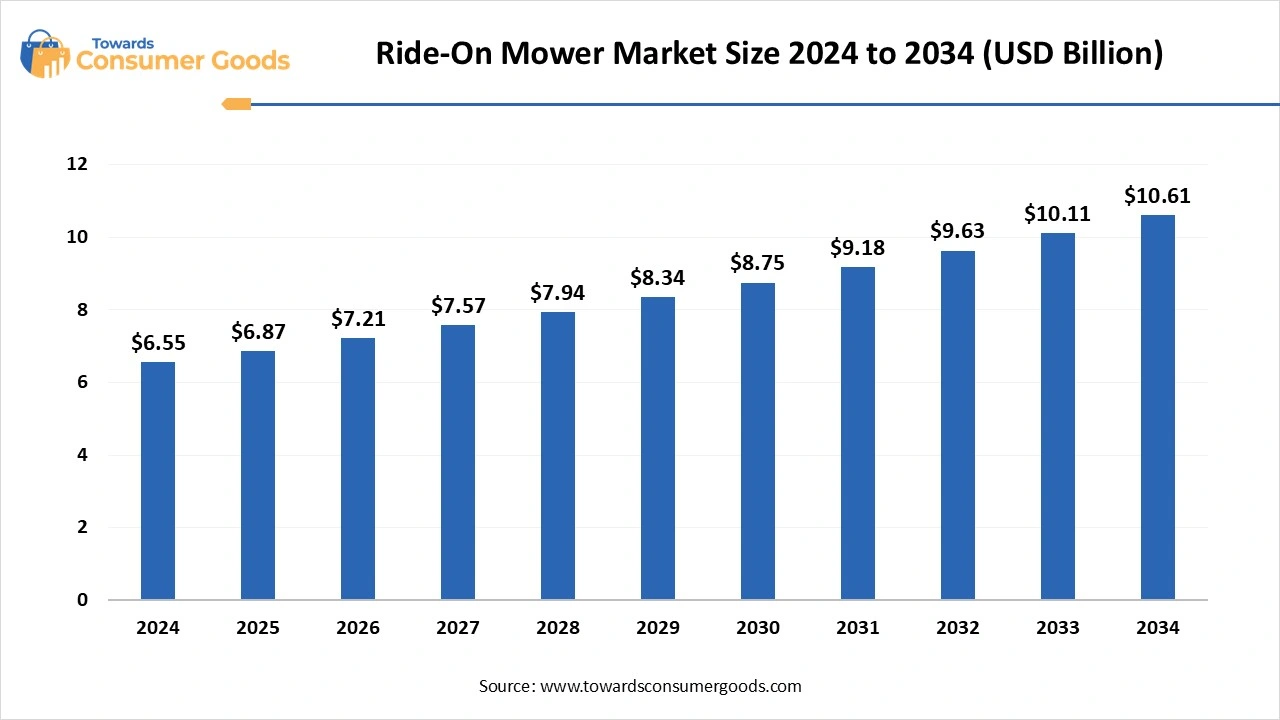

The global ride-on mower market size was valued at USD 6.55 billion in 2024 and is growing to approximately USD 10.61 billion by 2034, with a developing compound annual growth rate (CAGR) of 4.94% over the forecast period 2025 to 2034. The adoption of ride on mowers for professional and semi-professional golf courses and increased use in lawn and garden care have driven the market growth.

The ride-on mower market is fundamentally centered around the demand for efficient and effective maintenance of medium to large-sized lawns and open spaces. These machines are engineered to deliver both efficiency and productivity, essential for homeowners with expansive lawns and professional landscapers, golf course managers, and groundskeepers. The primary function of a ride-on mower is to cover larger areas of grass in significantly less time and with reduced physical effort compared to traditional walk-behind mowers, making them indispensable tools for maintaining vast green expanses.

Key to their operation are user-friendly features designed to enhance the operator's comfort and simplify the mowing process. This includes features such as adjustable seating that accommodates users of various heights, ergonomic controls positioned for easy access, power steering for effortless maneuverability, and hydrostatic transmissions that offer smooth acceleration and deceleration without the need for manual gear shifting. when it comes to cutting performance, users have high expectations for a clean, uniform cut that adapts well to various grass types and challenging terrains.

Important characteristics include adjustable cutting heights to customize the mowing experience according to user preference and lawn conditions, mulching capabilities that finely chop grass clippings for nutrient recycling, and size-specific rear discharge options that manage grass clippings effectively, ensuring a tidy lawn finish. Durability and reliability are critical considerations since ride-on mowers represent a significant financial investment. Buyers expect these machines to offer long-lasting performance with minimal downtime for maintenance and repairs, which can be a deterrent for many potential users.

The market showcases a range of ride-on mower types, including lawn tractors, zero-turn mowers, and rear-engine riders, each designed to cater to diverse lawn sizes, terrains, and individual user preferences. Continuous innovation in features such as the introduction of battery-powered mowers, the exploration of autonomous capabilities, smart connectivity, and enhanced maneuverability is continually reshaping this dynamic market.

Competition within this sector is robust, with numerous manufacturers vying for consumer attention through variations in pricing, performance, feature offerings, brand reputation, and after-sales service. Moreover, economic conditions, housing trends, and an increased awareness of lawn care and outdoor maintenance heavily influence market dynamics. Technological advancements, particularly in battery technology, are pivotal as the transition towards electric ride-on mowers gains traction in response to growing environmental concerns and a desire for lower operating costs. Furthermore, the incorporation of automation and robotics, still in the nascent stages for residential applications, is being explored for commercial purposes, signaling a shift towards semi-autonomous or fully autonomous ride-on mowers. Emerging smart features, such as enhanced connectivity, data collection capabilities, and remote control functionalities, are being integrated into certain models, providing additional conveniences for users.

| Attributes | Details |

| Market Size in 2025 | USD 6.87 Billion |

| Expected Market size in 2034 | USD 10.61 Billion |

| Growth Rate | CAGR of 4.94% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025- 2034 |

| High Impact Region | North America |

| Segment Covered | By Product,Fuel,Blade,Region |

| Key Companies Profile | Husqvarna Group, The Toro Company, Deere & Company, Kubota Corporation, MTD Products, Honda Motor Co. Ltd, Ariens Company, Briggs & Stratton, Stanley Black & Decker Inc.,Textron Inc. |

In professional settings such as golf courses, sports arenas, recreational facilities, and landscaping services, the adoption of ride-on mowers for efficient lawn maintenance is on the rise. This trend is bolstered by the ongoing expansion of these facilities, which further propels demand for high-performance mowers. Innovations such as remote-operated machinery, electronic speed control, and tight-turn technologies are attracting a growing customer base while significantly enhancing operational efficiency.

The industry is also witnessing a notable shift toward battery-powered ride-on mowers, driven by concerns about minimizing carbon emissions, reducing noise pollution, and decreasing maintenance burdens. Manufacturers are increasingly implementing promotional programs and initiatives that encourage the adoption and usage of ride-on mowers, fueled by a heightened interest in lawn care and gardening among the public, a trend that has gained momentum during recent events, ultimately expanding the potential customer base. The overarching need for efficient maintenance of larger gardens and open spaces remains a significant force behind this growing demand.

There is a significant opportunity in developing and manufacturing electric ride-on mowers specifically designed for the Indian climate and tailored to meet local user needs. This endeavor requires an emphasis on essential aspects such as extended battery range, compatibility with existing charging infrastructure, and the exploration of solar-assisted charging solutions to enhance sustainability.

With rising environmental awareness among consumers and the prospect of government incentives for electric vehicles, demand for robust and effective models is likely to surge in urban areas. To penetrate the market effectively, it's crucial to design and produce ride-on mowers that are not just durable and reliable but also competitively priced for both residential and smaller commercial users. This strategy may involve optimizing the design processes and localizing the sourcing of components to keep costs manageable.

The growing middle-class population and the expansion of commercial establishments present a substantial potential customer base for affordable ride-on mowers. Integrating smart and connected features into mid-range models can tap into the tech-savvy segment of consumers and businesses, making them likely early adopters. Features such as GPS tracking to prevent theft, maintenance reminders to promote upkeep, and basic performance monitoring systems could enhance user experience and operational efficiency.

Additionally, there is a long-term avenue to explore autonomous and semi-autonomous ride-on mowers, particularly for large-scale commercial properties. Customers like golf courses and gated communities may show interest in these advanced solutions as labor costs rise and technology continues to evolve, offering significant efficiency gains.

Moreover, designing ride-on mowers capable of traversing diverse terrains is essential, particularly in regions with uneven surfaces or challenging landscapes. This will require innovative approaches to component suppliers and the engineering of tougher cross-types that can withstand varied environments. With the burgeoning automotive and manufacturing ecosystem, there is also a formidable opportunity to supply high-quality, affordable, and locally manufactured battery packs for electric ride-on mowers. The sector is ripe for developing advanced electric motors and control systems that can power these innovative machines, further consolidating the region's capabilities in battery production and supply to meet growing demands.

North America has emerged as the leading region in the ride-on mower market, with the United States and Canada exhibiting a notable prevalence of single-family homes that often feature expansive lawns. This geographic characteristic sets North America apart from many regions around the globe, including Europe and much of Asia, where lawns tend to be smaller. As a result, there is a heightened demand for ride-on mowers designed for efficient and effective lawn maintenance. Several factors contribute to this demand. Firstly, the historically strong disposable income among North American consumers allows for greater expenditures on outdoor power equipment. Families and homeowners in the region have the financial flexibility to invest in high-quality ride-on mowers, which, while generally more expensive than push mowers, become more accessible due to this economic advantage.

Moreover, a well-established lawn care culture in North America further drives the market. Maintaining a lush, manicured lawn is not only a matter of property aesthetics but is also a significant aspect of home ownership. This cultural expectation fosters a continuous need for reliable lawn care tools, particularly ride-on mowers which are favored for their efficiency in maintaining large lawns.

Adding to this robust market environment is the extensive and mature retail infrastructure within North America. Consumers have access to a wide network of large retailers, home improvement stores, mass merchandisers, specialized outdoor power equipment dealers, and convenient online platforms, all of which ensure that ride-on mowers are easily obtainable. This established distribution channel not only facilitates sales but also supports after-sales services, enhancing customer satisfaction and product reliability.

In contrast, Europe has taken a different route and is recognized as the fastest-growing region within the ride-on mower market. The continent's increasing focus on environmental sustainability, paired with stringent regulations, has sparked a rapid evolution towards electric and battery-powered mowers. As eco-conscious consumers demand greener alternatives, government incentives and restrictions on gasoline-powered equipment are propelling this shift. Furthermore, Europe is at the forefront of adopting robotic lawn mowers. These devices, while not strictly categorized as ride-on mowers, represent a significant trend toward automated and convenient lawn care solutions, particularly for medium-sized residential lawns. The growing acceptance of robotic mowers indicates a robust appetite for innovation, which could also positively influence the ride-on mower sector as suburban expansion offers new markets for larger properties in nations like France and Germany.

The zero-turn mowers have emerged as the dominant product type within the market. These mowers are particularly prized for their exceptional maneuverability, enabling them to navigate tight corners and obstacles seamlessly. This capability significantly reduces mowing time and labor costs, making them ideal for both residential and commercial properties, especially as urbanization continues to increase the size of such properties.

The gasoline-powered segment led the ride-on mower market in 2024. Gasoline-powered ride-on mowers offer higher power and performance compared to electric or battery-operated models. They are capable of handling large lawns or rough terrains more effectively, making them ideal for both residential and commercial use.

Gasoline engines typically provide longer operational hours without needing frequent recharging, which is advantageous for larger properties or extended mowing sessions. This makes gasoline mowers more convenient for users who need continuous, uninterrupted operation. Gasoline-powered mowers have been in the market for a long time, and consumers are more familiar with their performance and maintenance. Fuel for these mowers is also widely available, making them more accessible for a broad customer base.

Rotary blades reign supreme in the market in 2024. These blades are designed for high rotational speeds and robust performance, making them suitable for various applications, from residential lawns to expansive venues such as golf courses, municipal parks, and sports fields. The efficiency of rotary blades allows them to cut through thick, uneven grass while effortlessly handling diverse terrain, thereby solidifying their popularity among consumers.

April 2025

April 2025

April 2025

April 2025