April 2025

The leather goods market was calculated at USD 471.19 billion in 2024 and is projected to reach around USD 832.75 billion by 2034 with a CAGR of 5.86%. The fashion evolution, rapid growth in e-commerce, and consumer preference towards branded clothes have driven the market growth.

The leather goods industry is a multifaceted sector that encompasses a diverse array of activities centered around the production, design, and sale of leather products. This comprehensive industry spans several processes, beginning with the tanning of raw hides to ensure durability and aesthetic appeal, and culminating in the manufacturing of finished leather items such as high-quality footwear, stylish apparel, luxurious accessories, and sophisticated automotive interiors. Additionally, the industry plays a vital role in the global trade and distribution networks that facilitate the movement of these products worldwide. With significant employment opportunities, particularly in rural regions, the industry is a crucial contributor to the economy through both exports and domestic sales.

Structurally, the leather industry is divided into several key segments: tanning and finishing, footwear, leather garments, as well as miscellaneous leather goods such as saddlery and harnessing. The workforce in this sector is notably diverse, with women making up a considerable portion of the labor force, and a substantial percentage of employees consisting of young individuals. As the industry evolves, there is an increasing emphasis on sustainability, with many companies adopting eco-friendly practices and materials aimed at minimizing waste throughout the production process.

Globally, the leather goods market is witnessing a robust period of growth that is propelled by factors such as rising disposable incomes, shifting fashion trends, and an increase in tourism activities. These elements collectively enhance the demand for leather apparel, footwear, and accessories. As consumers find themselves more financially secure, they are inclined to indulge in luxury and discretionary purchases, particularly leather goods, which are celebrated for their versatility and sophisticated style. The uptick in domestic and international travel results in higher demand for essential leather items like luggage and travel accessories.

Advances in manufacturing technologies, including robotics and automation, are expected to enhance production efficiency while simultaneously reducing costs. With consumers becoming increasingly educated about various leather brands and their distinctive offerings, the demand for quality leather products continues to rise.

| Report Attributes | Details |

| Market Size in 2025 | USD 498.80 Billion |

| Expected Size in 2034 | USD 832.75 Billion |

| Growth Rate | CAGR of 5.86% |

| Base Year in Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, Type By Product, By Product, By Region |

| Key Companies Profiled | Adidas AG, Nike, Inc., Puma SE, Fila, Inc., New Balance Athletics, Inc., Knoll, Inc., Samsonite International S.A., VIP Industries Ltd., Timberland LLC, Johnston &, Murphy, Woodland Worldwide, Hermès International S.A., Louis Vuitton Malletier, VF Corp., COLLAR Company, LUCRIN Geneva, Nappa Dori, Saddles India Pvt. Ltd., Lear Corp. |

The global leather goods market is ripe with substantial opportunities driven by a combination of increasing disposable incomes, evolving fashion trends, and heightened consumer spending habits. The market is notably segmented into various product types, including footwear, luggage, and accessories, as well as distribution channels encompassing both online and offline retail outlets. In particular, the e-commerce sector has emerged as a significant growth avenue, with brands increasingly utilizing digital platforms to broaden their reach and foster connections with consumers.

Furthermore, the consumer shift toward sustainability is paving the way for a new era of eco-friendly products, presenting businesses with unique opportunities to promote the sustainable aspects of their offerings. With the rapid rise of online shopping, leather goods companies can now engage a wider audience and enhance their distribution networks. There is also a burgeoning demand for high-quality, luxurious leather products, which presents golden opportunities for businesses aiming to attract discerning consumers who prioritize quality and craftsmanship.

Despite the promising landscape, the global leather goods market contends with several significant challenges. Environmental concerns loom large, as the industry's impact on ecosystems remains a critical issue. Additionally, the competition from synthetic alternatives continues to intensify, alongside the challenges posed by high production costs and the volatility of raw material prices. Ethical dilemmas related to animal welfare further complicate the industry's standing, engaging consumer scrutiny about sustainability practices.

The environmental ramifications of leather production—including deforestation, water pollution, and greenhouse gas emissions associated with cattle farming and the tanning process—have become increasingly prominent concerns among consumers. Simultaneously, rising awareness regarding the ecological footprint of leather production is propelling the demand for vegan and sustainable alternatives, significantly influencing evolving consumer preferences in the marketplace.

The dominance of genuine leather in the leather goods market can be attributed to its status as a symbol of luxury, exceptional durability, and undeniable aesthetic appeal. Consumers, particularly those who seek top-tier and long-lasting items, gravitate towards genuine leather products. Additionally, the growing emphasis on sustainability and ethically sourced leather is further enhancing the allure of genuine leather among consumers who prioritize environmentally conscious choices. This material is frequently associated with sophistication, quality, and elevated social status, making it a sought-after option for upscale items such as handbags, footwear, and various accessories. Known for its remarkable resilience and capacity to endure recurrent use, leather is often favored for products intended to withstand the rigors of everyday life.

On the other hand, synthetic leather has emerged as the fastest-growing segment within the leather goods market, primarily due to its affordable pricing, impressive durability, and ethical considerations when compared to genuine leather. The rising awareness surrounding animal welfare and environmental impact has also fueled the demand for sustainable alternatives, making synthetic leather a popular and viable option. Advances in manufacturing techniques have led to the development of synthetic leathers that are not only of superior quality but also more durable than ever. Furthermore, the introduction of innovative materials, such as bio-based leathers, enhances the sustainability and appeal of synthetic leather products, offering a modern twist on traditional leather goods.

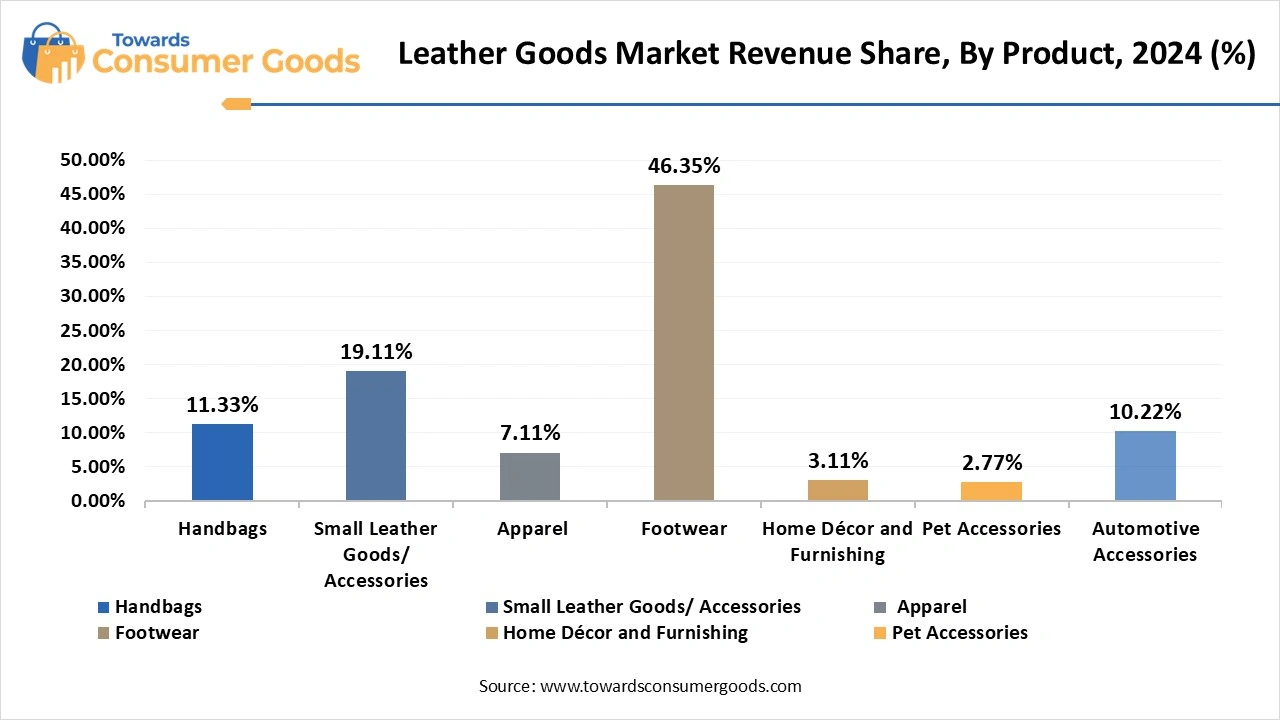

The footwear segment holds a commanding position in the leather goods market, driven by a robust demand propelled by a combination of factors such as long-lasting durability, enhanced comfort, and prevailing fashion trends. This segment is also a hotbed for innovation, with regular introductions of new designs and technologies that further consolidate its market share. As footwear remains an essential aspect of daily life, the need for stylish, comfortable, and resilient shoes remains consistently high. Leather’s inherent qualities of durability and versatility make it an excellent choice for various styles of footwear, ranging from performance-oriented athletic shoes to elegant dress shoes suitable for formal occasions.

In parallel, the market for leather automotive accessories is witnessing exponential growth, driven largely by the surging demand for high-quality leather seats and other interior elements, particularly within luxury vehicles. Leather is often perceived as a high-end material, and its application within automotive interiors significantly enhances the perceived value and prestige of a vehicle. With an established reputation for durability and resistance to wear and tear, leather stands out as a practical and desirable choice for automotive interiors, particularly in terms of seat coverings and other decorative elements.

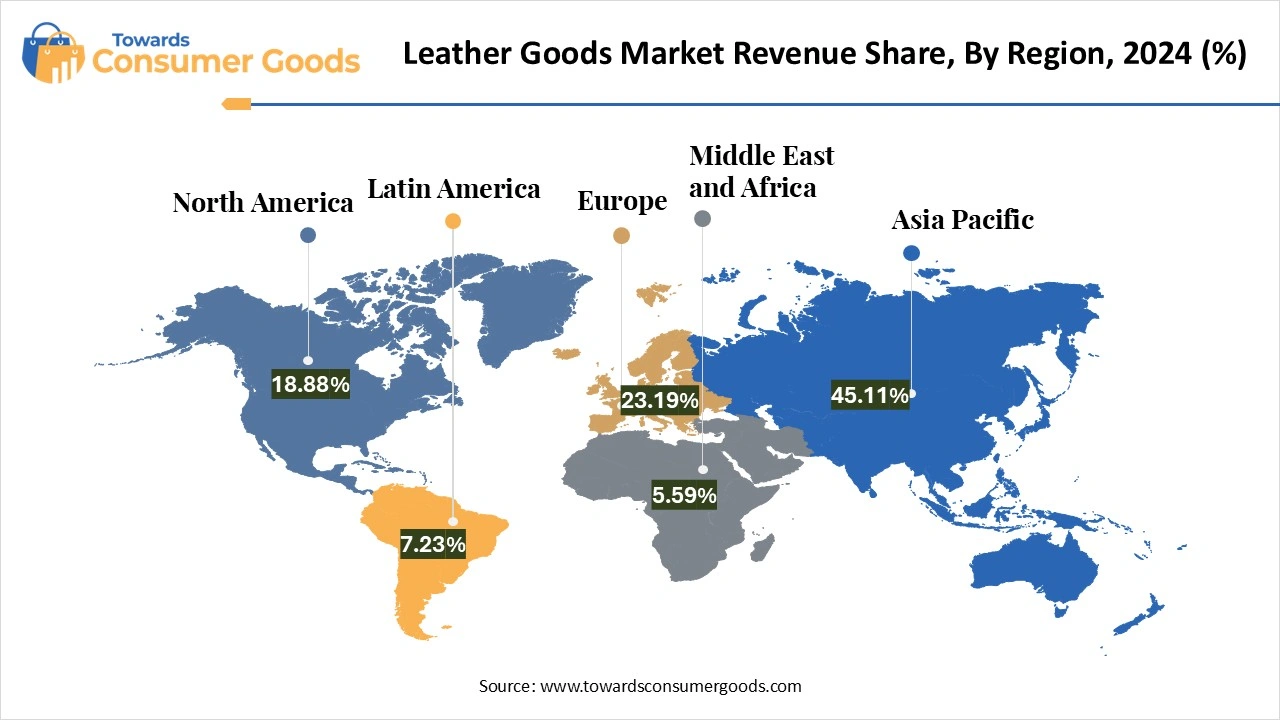

The Asia-Pacific region commands a dominant position in the global leather goods market, attributed to its remarkable manufacturing capabilities, a vast consumer base, and a burgeoning appetite for premium and luxury leather products. Countries such as China and India are pivotal to the region's leadership in this sector. These nations serve as major manufacturing hubs, producing a wide assortment of leather products including fashionable clothing, durable footwear, and elegant accessories. As consumers in Asia-Pacific become more affluent and style-conscious, their desire for high-end and luxury leather products grows. The sector's continued advancements in production techniques and processing, supported by favorable government policies, further cement the region's dominant market position.

In Europe, the leather goods market is also experiencing rapid growth, fueled by a combination of factors including a diverse and affluent consumer base, the presence of prestigious luxury brands, high levels of tourism, and an increasing emphasis on sustainable innovation. These dynamics contribute to the region's elevated demand for leather products, particularly within the luxury and high-end sectors. European consumers exhibit a wide range of preferences, from those seeking affordable leather footwear to those desiring exclusive luxury goods such as high-end bags and accessories. Moreover, Europe is home to numerous influential luxury leather brands and designers, which reinforces a strong presence in the market for high-quality, branded leather items.

Tamil Nadu RIGHTS Initiative

Mitsubishi Chemical Group

Faircraft

April 2025

April 2025

April 2025

April 2025