April 2025

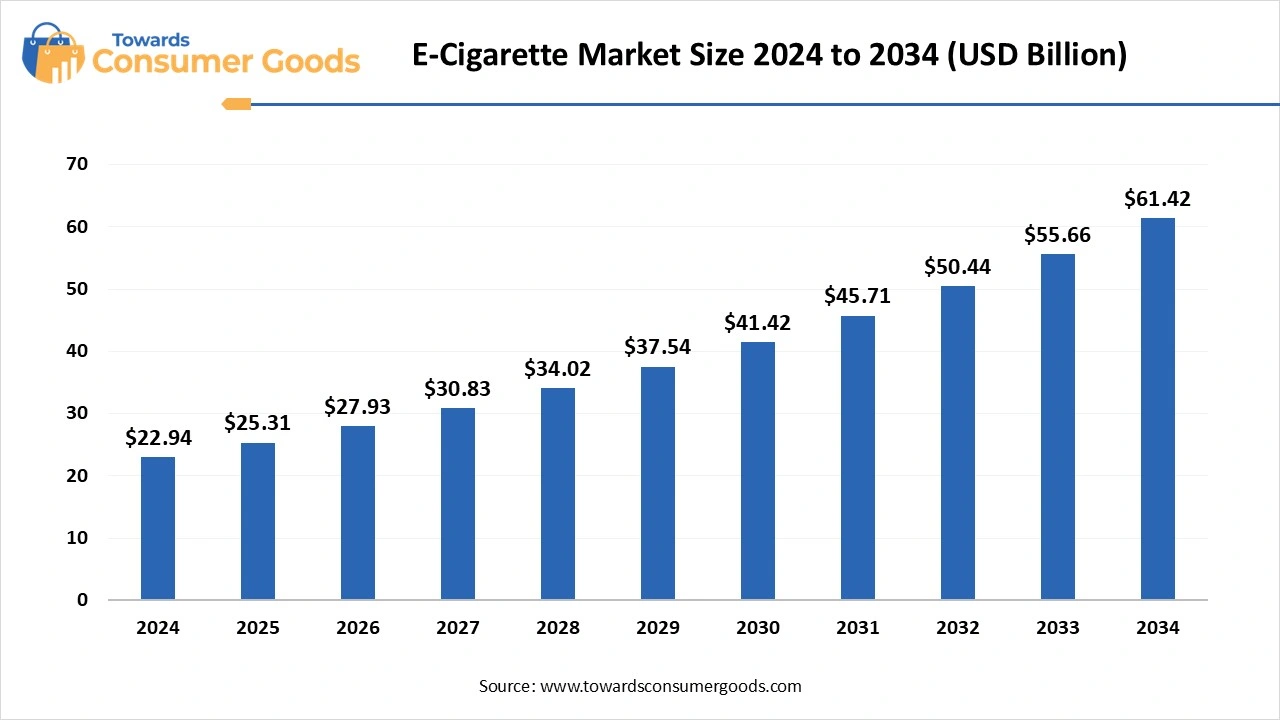

The e-cigarette market was calculated at USD 22.94 billion in 2024 and is projected to reach around USD 61.42 billion by 2034 with a CAGR of 10.35%. The consumer preferences towards e-cigarettes and the customization of them based on their nicotine levels have driven the market growth.

The e-cigarette industry is centered on the development, distribution, and promotion of electronic nicotine delivery systems (ENDS). These battery-powered devices are designed to heat a liquid solution, typically containing nicotine, to generate an inhalable aerosol. The industry's primary aim is to present an alternative to traditional cigarettes, often touting e-cigarettes as a less harmful option or as aids to help smokers quit. This sector is characterized by continuous innovation, with manufacturers introducing an array of new e-cigarette designs, enticing flavors, and advanced technologies, including devices that leverage artificial intelligence (AI) to enhance user experiences dynamically.

As the industry develops, it faces a patchwork of regulations that vary significantly across different nations and regions, influencing the availability of products, marketing strategies, and overarching public health implications. The e-cigarette market has been witnessing remarkable growth, increasing competition among diverse stakeholders, such as established tobacco companies, emerging startups, and e-commerce platforms.

Several factors are powering this expansion, including the escalating demand for reduced-risk products among consumers seeking safer alternatives to traditional smoking. E-cigarettes have gained traction as a means of harm reduction, driving consumer interest. Their appeal is further enhanced by a broad spectrum of flavor options and customizable nicotine levels, catering to individual user preferences.

Ongoing advancements in e-cigarette technology, such as longer-lasting batteries, temperature regulation, and enriched user interfaces, are propelling market vitality. The rise of online retail and e-commerce has also simplified the purchasing process, making e-cigarettes more accessible than ever. Many users turn to e-cigarettes as part of their nicotine replacement therapy, facilitating a transition away from combustible tobacco products by providing varied nicotine levels, potentially reducing dependency over time.

| Report Attributes | Details |

| Market Size in 2025 | USD 25.31 Billion |

| Expected Size in 2034 | USD 61.42 Billion |

| Growth Rate | CAGR of 10.35% |

| Base Year in Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | North America |

| Segment Covered | By Product Type, By Flavor, By Distribution Channel, By Region |

| Key Companies Profiled | Altria Group, British American Tobacco, Imperial Brands, International Vapor Group, Japan Tobacco, NicotekLlc, Njoy Inc., Philip Morris International Inc., Reynolds American Inc., VMR Flavors LLC |

The global e-cigarette industry is rife with promising opportunities, propelled by a growing demand for alternatives to traditional smoking, evolving regulatory landscapes, and an increasing focus on harm reduction strategies. Notable opportunities within this market include the potential for product innovation, expansion into diverse distribution channels, and targeting specialized consumer segments. For instance, developing advanced e-cigarette technologies that enhance flavor profiles, reduce nicotine levels, or utilize environmentally sustainable materials can draw in new customers while increasing overall market share. Furthermore, the online retail segment is experiencing rapid growth; consequently, expanding distribution capabilities through various online platforms, physical retail establishments, and possibly collaborations with other businesses could significantly enhance market reach and penetration.

Nevertheless, the e-cigarette market is confronted with several formidable challenges that may hinder its growth trajectory. Legal constraints, particularly regulations such as those instituted in India that prohibit the production and sale of e-cigarettes, pose significant barriers. Health-related apprehensions regarding vaping, such as worries about vaping-associated illnesses and the risks of explosive or malfunctioning devices, diminish consumer confidence and acceptance of these products. Furthermore, many individuals continue to view e-cigarettes merely as an alternative form of tobacco, despite evidence suggesting they are less harmful than traditional cigarettes, which can impede their utilization in smoking cessation efforts.

While e-cigarettes are commonly recognized as a safer alternative to conventional smoking, ongoing concerns about their long-term health implications and the potential occurrence of vaping-related illnesses remain. The negative media coverage surrounding these health issues may discourage potential users and complicate efforts to position e-cigarettes as safe alternatives. Additionally, the risk of product defects, ranging from malfunctioning atomizers to battery-related explosions, can severely undermine consumer trust and raise safety alarms. A lack of transparency concerning product safety and insufficient maintenance guidelines can exacerbate these challenges, further complicating consumer acceptance and market growth.

The disposable e-cigarette segment stands out as the leading category within the vaping market, primarily due to its remarkable convenience, user-friendly design, and broad appeal to both novice and experienced vapers. On the other hand, open-system disposables have carved out a niche for more seasoned vapers seeking to personalize their vaping experience. The growth of this segment is further fueled by an increasing demand for smoking cessation devices and a noticeable shift toward discreet, convenient alternatives that cater to modern lifestyles. Their compact size and lightweight structure make these disposable devices perfect for individuals who are frequently on the move or prefer to vape discreetly in public spaces.

Conversely, the rechargeable e-cigarette segment is experiencing the fastest growth trajectory within the market, attracting attention due to its cost-effectiveness, convenience, and customizable features—qualities that resonate with both long-time smokers and those new to vaping. Additionally, the availability of customizability—allowing users to experiment with various flavors and adjust vaping settings—aligns with the interests of a broader audience, particularly those looking to tailor their vaping experience to their preferences. Many modern rechargeable devices come equipped with USB charging capabilities, providing a hassle-free recharging option without the requirement for specialized chargers. Features such as wattage and temperature control allow users to fine-tune their vaping settings, further enhancing personalization.

In terms of flavor preferences, the tobacco category reigns supreme within the e-cigarette market for a multitude of reasons. The well-documented health risks associated with traditional tobacco smoking, combined with the perception of e-cigarettes as a safer alternative, have prompted a surge in consumer interest. Additionally, the continuous development of innovative e-cigarette products and their accessibility through various distribution channels reinforce the dominance of the tobacco segment. As health awareness grows, many individuals actively seek alternatives perceived as safer, such as e-cigarettes.

The botanical flavor segment, on the other hand, is rapidly gaining traction in the e-cigarette market due to an increased consumer demand for natural and health-oriented options. Botanical flavors—often derived from herbs and plants—appeal to those desiring a shift from conventional vaping experiences, offering a more organic and perceived safer alternative. This trend is closely linked to rising health consciousness and a preference for natural products, positioning the botanical segment as a promising niche with significant potential for growth. This shift towards natural, health-focused products extends into the vaping realm, as consumers increasingly pursue a holistic and wellness-centered approach to their habits.

From a distribution channel perspective, e-cigarette shops dominate the market landscape thanks to their accessibility, diverse product offerings, and the experiential opportunity for customers to sample products prior to making a purchase. The appeal of e-cigarette shops, particularly specialized vape stores, lies in their extensive selection of devices and electronic liquids, enabling customers to physically inspect items, taste various flavors, and receive informed guidance from knowledgeable staff.

Meanwhile, the online distribution channel is emerging as the fastest-growing segment in the e-cigarette market, driven by factors such as convenience, competitive pricing, and a broader selection of products. Online retailers cater to consumer preferences by providing comprehensive product information, user reviews, and tailored recommendations, greatly enriching the overall shopping experience. By enabling consumers to browse and purchase e-cigarettes from the comfort of their homes at any time, online shopping presents a compelling option. Additionally, online vendors frequently offer competitive pricing and special promotions, appealing to price-sensitive consumers looking for value.

North America leads the e-cigarette market, underpinned by high usage rates, especially among younger demographics, and a well-established infrastructure for the production, distribution, and consumption of these products. In fact, the United States exhibits one of the highest rates of e-cigarette usage among adults compared to other parts of the world. Moreover, rapid technological advancements in e-cigarettes have spurred innovation, yielding a plethora of exciting new products appealing to consumers. Canada also plays a vital role in the North American e-cigarette market, characterized by its distinct regulatory landscape. While there are no overarching federal laws dictating where vaping can occur, each province and territory enforces individual regulations, leading to a complex regulatory environment for consumers and businesses alike.

In the Asia-Pacific region, the e-cigarette market is undergoing swift growth driven by increasing awareness of the health risks associated with traditional tobacco products, as well as rising consumer demand for safer alternatives. Japan has emerged as a pivotal player in this market expansion. This growth is evident through supportive government initiatives that advocate for e-cigarettes as a safer alternative and a significant population of existing smokers transitioning to these products. Moreover, Japan has become a hub for technological innovation within the e-cigarette industry, with companies like Japan Tobacco International (JTI) at the forefront, rolling out groundbreaking products that cater to changing consumer preferences.

BAT Rossmann

R.J. Reynolds Vapor Company (RJRVC)

Altria

April 2025

April 2025

April 2025

April 2025