April 2025

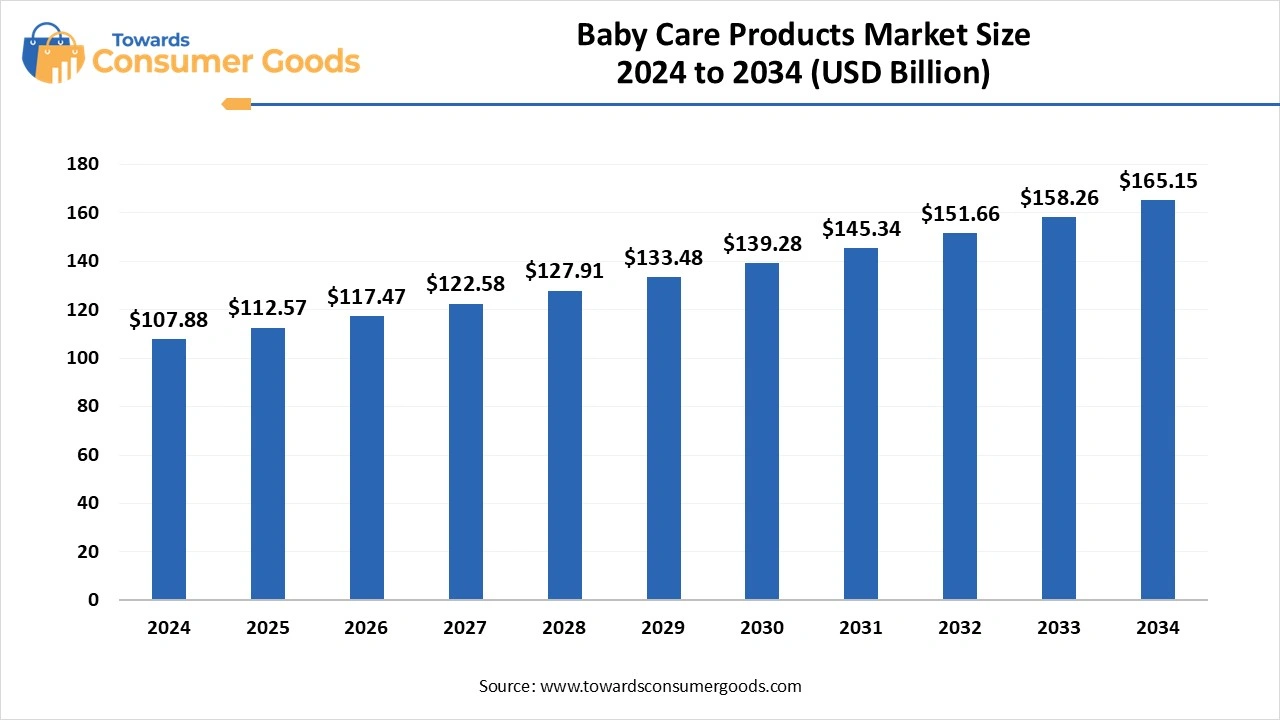

The global baby care products market size is calculated at USD 107.88 billion in 2024, grew to USD 112.57 billion in 2025, and is projected to reach around USD 165.15 billion by 2034. The market is expanding at a CAGR of 4.35% between 2025 and 2034.The demand for baby care products is attributed to the rapid increase in the birth rate of developing economies, which are creating business demand for companies.

Baby care products refer to items specifically designed to help babies maintain their overall health, comfort and hygiene. These products are made using special materials that differ from the regular ones as they protect from allergies and infections. The baby care products market is expanding rapidly due to the rising demand for various products like lotions, creams, shampoos, disposable diapers, cloths, wipes, and many more. The rising research is focusing on developing comfort-based products for baby care.

The rising awareness regarding infant health and hygiene is playing a major role in attracting significant demand. The rising presence of pediatricians in developing cities and online is the major reason behind the rising awareness regarding babies, which is raising the demand for these products to prevent them from skin infections and other health-related conditions. The baby care products market is growing rapidly, as companies are also promoting these products through regular health campaigns in maternity hospitals. The rising collaborations of the companies are also expected to create significant business opportunities for them in the upcoming years. The rising digital presence of these brands is also anticipated to help in the long run.

| Report Attributes | Details |

| Market Size in 2025 | USD 112.57 Billion |

| Expected Size in 2034 | USD 165.15 Billion |

| Growth Rate | CAGR of 4.35% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | North America |

| Segment Covered | By Product, By Age Group, By Price Range, By Distribution Channel, By Region |

| Key Companies Profiled | Nestlé S.A.,Johnson & Johnson ,Abbott Laboratories,Artsana Group,Babyganics LLC,Burt's Bees (Clorox Company),Carter's, Inc.,Graco (Newell Brands),Kimberly-Clark Corporation , Laboratoires Expanscience,Munchkin, Inc.,Pigeon Corporation,Procter & Gamble (P&G),Seventh Generation Inc.,The Honest Company |

Rising Popularity of Organic and Natural Products

The rising consumer awareness regarding alcohol and chemical-based products has played a significant role in changing consumer preferences towards organic products. The newborns usually have sensitive skin, which is promoting the use of natural additives in these products, which are helping towards the growth of the baby care products market. The companies are adopting the use of natural ingredients like aloe vera, chamomile, and other natural which also comply with sustainable practices. The organizations are also setting their guidelines, which ensure the safety of the consumers. Additionally, the rising trend for clean-label products is expected to play a vital role in the growing businesses of companies.

Higher Production Costs

The rising use of organic products has led towards the rapid demand for investments in organic materials, which are usually higher in cost. The baby care products market may face certain challenges here due to the rapidly increasing birth rates in the underdeveloped regions, which make these products unaffordable. Additionally, the healthcare facilities also lack in these regions, which may lead towards the limited availability of these products.

North America dominated the global baby care products market by generating the highest revenue share in 2024. The dominance of the region is attributed to the higher disposable incomes in countries like the US and Canada, which increases the expenditure limit of the parents on baby care. This is leading towards the innovation of new products in the industry due to higher demand. The rising health awareness is also playing a significant role, as consumers are inclined towards clean-label products.

The United States stands as a prominent player in the North American market due to the presence of regulatory bodies like the FDA, which are significantly investing in sustainable products. The baby care products market is growing rapidly due to the increasing presence of e-commerce, which is boosting the business of global companies. The US government is also implementing advanced healthcare services in the maternity hospitals, which is expected to boost business opportunities in the future.

Asia Pacific is observed to rise at the fastest CAGR during the forecast period of 2025 to 2034. The growth of the region is attributed to the increasing birth rates in countries like India and China. The baby care products market is expanding rapidly, where the middle-class population are increasing their spending capacities on baby care products. Additionally, the social media influence is helping companies to introduce new products for the convenience of individuals.

China is one of the dominant players in the Asia Pacific market due to the rising number of middle-class families in the country. The Chinese government is promoting the business through local and global companies, which is helping individuals to seek these products at an affordable price. The manufacturing capabilities are also anticipated to grow as the country has advanced manufacturing capabilities throughout various industries.

The baby diapers and wipes segment generated the highest revenue share in 2024. The dominance of the segment is attributed to the frequent use of diapers and wipes, which help in maintaining the hygiene of the baby. The baby care products market is growing rapidly as companies are investing rapidly in products which can be used in urban lifestyles. For example, companies like Huggies, Pampers are offering disposable diapers and wipes, which can be used in the busy work schedules of the parents. Additionally, the pediatricians are promoting these products to increase awareness regarding human hygiene.

The baby food and formula segment is anticipated to grow at the highest CAGR during the forecast period of 2025 to 2034. The segment includes products like cereals, purees, and many more, which are specially designed for newborn consumption. The initial stages of newborns highly rely on their nutrition, which helps the healthy development of their bodies. As a result, the companies are innovating new products which can help in catering for the nutritional demands of babies. The baby care products market is expected to grow rapidly as these products are anticipated to gain more demand due to the rising number of working mothers.

The crawlers (7 to 12 months) segment generated the highest revenue share in 2024. The category includes the wider demand for products like diapers due to the rising activity levels of babies. Hygiene becomes a crucial factor among these age groups due to the higher risks of infections and skin infections. As a result, the baby care products market is gaining significant popularity as companies are investing in the development of new products like lotions, wipes, and rash creams.

Many companies are offering clean-label products due to the rising number of paediatrician visits by parents. Additionally, the changing work lifestyles are anticipated to witness significant product advancements which offer advanced products that provide longevity.

The toddlers (1 to 3 years) segment is expected to rise at the highest CAGR during the forecast period of 2025 to 2034. The segment deals with products that play a vital role in the transition years of the baby. The demand for toddler-safe shampoo and lotions is gaining significant popularity due to the growing user base. The companies are also investing in products that ensure the nutrition of those babies. Additionally, the changing work lifestyles of the parents are anticipated to create demand for products like large-size diapers and educational toys.

The medium segment accounted for the highest revenue share in 2024. The segment deals with the production of baby care products that offer quality at an affordable price. The rising middle-class population is playing a major role in attracting a wider consumer base through wider product offerings at the medium range. The baby care products market is expected to grow more rapidly as the global brands are also focusing on offering high-quality products at an affordable price. The rise of retail channels is expected to offer higher discounts on bulk purchases.

| By Price Range | Revenue Share 2024 (%) |

| Low | 28.33% |

| Medium | 55.85% |

| High | 15.82% |

The offline segment accounted for the highest revenue share in 2024. The dominance of the segment is attributed to the wider presence of physical stores like speciality stores, supermarkets, pharmacies and others. The baby care products market is expanding rapidly due to the trust of these stores that have managed to offer services to consumers over the past decades. Many of these stores are located near the hospitals and baby care clinics, which helps the companies to increase their business partnerships with them. Additionally, the growing number of chains like Walmart, D-Mart and others are offering these products at heavily discounted rates, which helps in attracting a wider consumer base.

The online segment is anticipated to grow at the highest CAGR during the forecast period of 2025 to 2034. The changing lifestyle patterns are managing to mark significant growth in the businesses. The online companies, including e-commerce, are offering same-day delivery options for these products, which is helping the companies make more revenue. The baby care products market is expected to rise rapidly as these online stores are providing additional discounts to consumers through coupons and subscriptions.

Soft N Dry

By Product Type

By Age Group

By Price Range

By Distribution Channel

By region

April 2025

April 2025

April 2025

April 2025