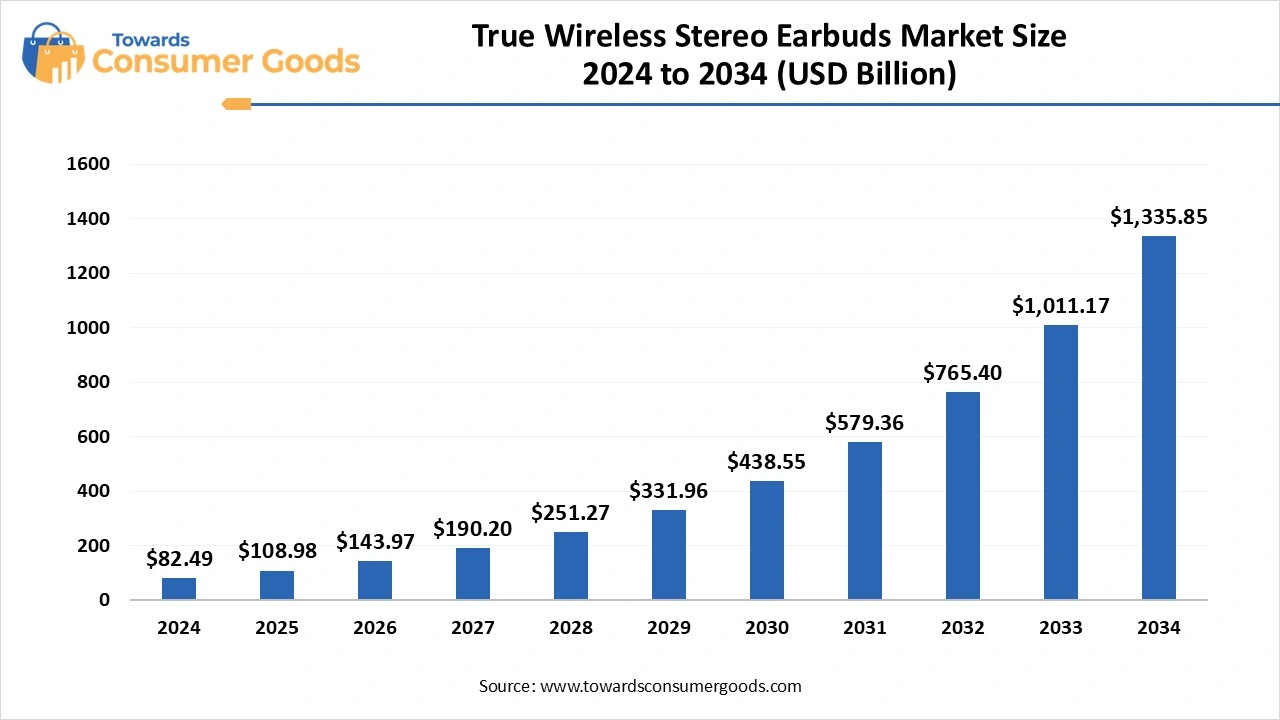

The True Wireless Stereo (TWS) Earbuds Market was calculated at USD 82.49 billion in 2024 and is projected to reach around USD 1,335.85 billion by 2034, with a CAGR of 32.11%. The increased use of smartphones in daily lives and integration, and consumer preference towards wireless audio have driven the market growth.

The true wireless stereo (TWS) earbuds market is centered on delivering convenient and portable audio solutions, propelled by rapid technological innovations, shifting consumer preferences, and the seamless integration of these devices with smartphones and wearables. Key attributes influencing this sector include features such as active noise cancellation (ANC), extended battery life, and enhanced sound quality, which collectively enhance the listening experience.

In this competitive landscape, established brands are prioritizing innovation and resourceful ecosystem integration to maintain their market presence, while emerging brands are introducing unique features at competitive prices to differentiate themselves. The primary allure of TWS earbuds lies in their wireless design, making them especially appealing for active lifestyles and providing users with a hassle-free auditory experience while on the go.

As the industry evolves, significant strides are being made in areas such as noise cancellation technology, Bluetooth connectivity advancements, and improvements in battery longevity, leading to a superior user experience. Today's consumers are increasingly inclined toward earbuds that offer smart voice assistants, wireless charging capabilities, and customization options, reflecting a broader trend toward personalization and health-conscious functionalities.

Companies are continuously exploring unique designs and advanced features to capture consumer attention in this crowded market. Moreover, the fluid integration of TWS earbuds with smartphones, smartwatches, and other wearable technologies not only enhances their functionality but also improves user experience. The global demand for wireless earbuds is swelling, fueled by a rise in disposable income levels and a growing adoption of streaming services, thereby creating new avenues for market expansion.

The TWS earbuds market is currently experiencing remarkable growth, primarily attributed to the higher penetration of smartphones, a burgeoning demand for wireless audio solutions, and the emergence of cost-effective products that make premium features accessible to a broader audience. Technological advancements such as sophisticated noise cancellation systems and the inclusion of smart features are propelling this growth. An increasing number of smartphone users seek out convenient wireless audio solutions, further stimulating market demand.

Additionally, the rising availability of affordable TWS options has widened the demographic reach of these products, making them attractive to a diverse range of consumers. Features such as active noise cancellation, integrated smart assistants, and superior audio quality are proving to be compelling draws for buyers, simultaneously inspiring innovation within the sector. Users invested in specific ecosystems, like those offered by Apple or Samsung, preferentially choose TWS earbuds that promise seamless interactions with their devices.

Health-conscious consumers are gravitating toward TWS earbuds equipped with fitness tracking functionalities, while the simple accessibility of purchasing these products online is significantly contributing to market expansion. The wireless nature of TWS earbuds grants users a limitless listening experience, ideal for multitasking and various activities, aligning perfectly with contemporary fast-paced lifestyles. Continuous advancements in audio codecs and technologies are not only enhancing sound quality but are also facilitating a more immersive auditory experience.

| Report Attributes | Details |

| Market Size in 2025 | USD 108.98 Billion |

| Expected Size in 2034 | USD 1,335.85 Billion |

| Growth Rate | CAGR of 32.11% |

| Base Year in Estimation | 2024 |

| Forecast Period | 2025-2034 |

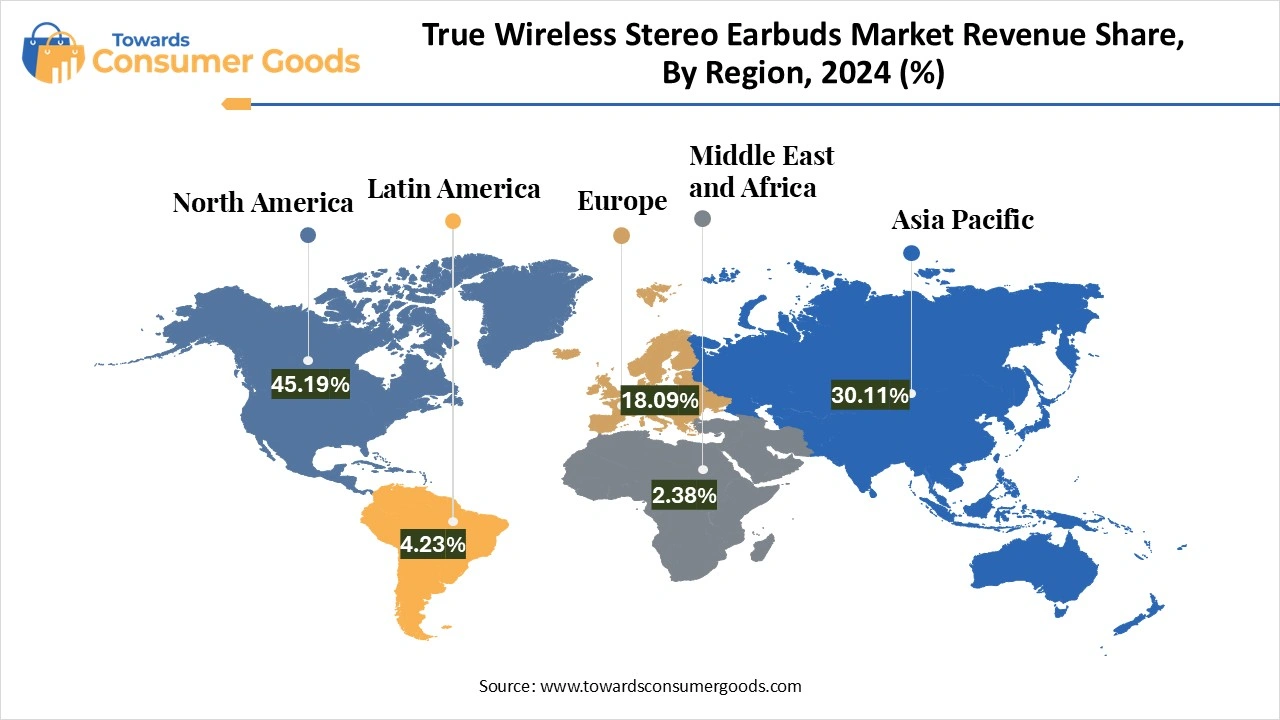

| Dominant Region | North America |

| Segment Covered | By Price Band, By Region |

| Key Companies Profiled | Apple Inc., Bose Corporation, Jabra, Harman International Industries, Incorporated, Sony Corporation, Sennheiser Electronic GmbH & Co., Xiaomi |

The increasing prevalence of smart devices, particularly smartphones and tablets, has significantly amplified the demand for wireless earbuds, which provide a seamless and convenient audio experience while on the move. These earbuds have garnered particular popularity among fitness enthusiasts due to their lightweight design and the capability to monitor and track workout sessions effectively. With the rising global consciousness regarding health and wellness, the market for wireless earbuds is experiencing a notable boost.

The evolution of online retail channels plays a pivotal role in facilitating consumer access to a wide range of wireless earbuds, thereby propelling market expansion. Recent advancements in audio technology, such as active noise cancellation that immerses listeners in their audio environment, and spatial audio, which enhances the overall listening experience, are becoming increasingly attractive selling points for customers.

The Asia-Pacific region stands out as a dominant market for wireless earbud sales, propelled by rising disposable income and a burgeoning “audiophile” culture that appreciates high-quality sound. In particular, the remarkable surge in smartphone usage and mobile gaming in India is contributing to a heightened demand for versatile wireless earphones that seamlessly support music enjoyment, phone calls, and gaming needs.

Moreover, there is a marked interest in premium audio devices that boast innovative features and deliver superior sound quality. Overall, the wireless stereo earbuds market is on the brink of significant growth, with emerging opportunities influenced by technological advancements, evolving consumer preferences, and the extension of market reach into new regions. To thrive in this dynamic market, it becomes essential to understand and adapt to the ever-changing landscape of consumer demands and technological developments.

However, the true wireless stereo (TWS) earbuds market is confronted with various challenges, including limitations regarding battery life, security vulnerabilities, competition posed by counterfeit products, and price sensitivity, particularly prevalent in emerging markets. A considerable concern for many users is the TWS earbuds' average battery lifespan, which typically ranges between 3 to 4 hours. This poses a challenge for those engaged in longer listening sessions or intensive workout routines. Additionally, the reliance on Bluetooth connectivity makes these earbuds susceptible to potential hacking, raising valid concerns about data breaches and privacy risks.

The proliferation of counterfeit earbuds, available both online and in brick-and-mortar stores, undermines the legitimacy of recognized brands and poses a threat to overall market integrity. Such counterfeit products often lure consumers with lower price points, which can hurt the demand for authentic items. In emerging markets like India, this price sensitivity often takes precedence, leading many consumers to prioritize affordability over premium features and brands, thus constraining the growth potential of higher-end products. While wireless connectivity is touted as a primary feature, connectivity issues, particularly over long distances, present frustrations for some users, underscoring the need for improved range and stability to enhance the overall user experience.

The rising popularity of open earbuds, which emphasize environmental sustainability and situational awareness, introduces additional complications, such as the necessity for market education, competition from well-established brands, and the balancing act of affordability and product maturity. Moreover, smartphone manufacturers are increasingly bundling their earbuds within their ecosystems, creating competitive challenges for smaller brands attempting to carve out their niche, particularly in terms of distribution and brand visibility.

The segment of true wireless stereo earbuds priced between USD 100 and USD 199 has emerged as the leading category within the market. This dominance can be attributed to a confluence of factors, including growing consumer demand, increasing popularity among diverse demographic groups, and a competitive balance between affordability and desirable features. This specific price bracket is particularly appealing to consumers seeking a high-quality listening experience without making a substantial financial commitment.

The budget segment in the true wireless stereo (TWS) earbuds market is currently witnessing the most rapid growth, driven by a confluence of compelling factors. Key among these is affordability, alongside a rising demand for entry-level TWS earbuds that cater to a diverse consumer base. The competitive price point of these TWS earbuds ensures they are accessible to a wider array of consumers, especially those who may previously have found premium models out of reach.

Many individuals are either exploring their first TWS earbuds or searching for budget-friendly alternatives to upgrade their existing audio devices. The cost-effectiveness, combined with user-friendly designs, positions TWS earbuds in this price range as appealing options for various user demographics, such as fitness enthusiasts seeking sports-oriented earbuds, students in need of reliable audio solutions for studying, and casual users desiring straightforward wireless audio without unnecessary frills.

In response to this growing demand, manufacturers are pouring resources into research and development, focusing on enhancing features such as superior sound quality, extended battery life, and more durable designs to meet consumer expectations within this price segment.

North America is at the forefront of the True Wireless Stereo (TWS) Earbuds market, propelled by a variety of contributing factors. The region boasts exceptionally high internet usage and a strong consumer appetite for premium technology, combined with an early adoption of cutting-edge products. As the region with the highest global internet usage rate, North America boosts demand for TWS earbuds that effortlessly connect to various devices and online services.

The tech-savvy demographic here is constantly eager to embrace new technologies, particularly those offering high-quality audio experiences. Notably, North America tends to be one of the first regions where new TWS earbuds models are launched, showcasing innovations and sophisticated features.

Conversely, the Asia-Pacific region is experiencing unparalleled growth in the wireless stereo earbuds market, thanks to several pivotal dynamics. For starters, the region is marked by extraordinarily high smartphone adoption rates, which increases the popularity of wireless earbuds as a trendy accessory. Additionally, local and regional brands are gaining traction by offering competitively priced, feature-rich TWS earbuds that appeal to a wider audience, effectively making high-quality audio technology accessible to many.

TPV Technology

Huawei

Noise