April 2025

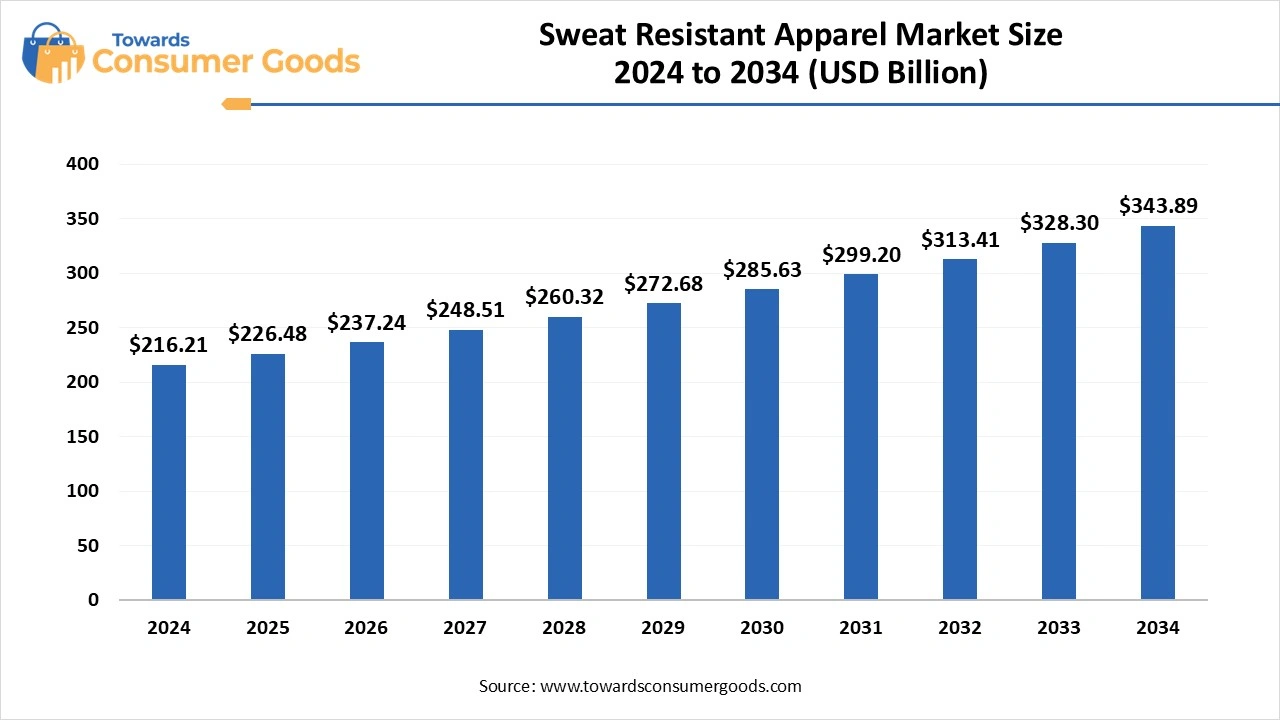

The sweat resistant apparel market accounted for USD 216.21 billion in 2024 and is expected to reach around USD 343.89 billion by 2034, with a CAGR of 4.75% from 2025 to 2034. The demand for sweat resistant apparel is increasing due to the rising adoption of active lifestyles by individuals, which promotes this apparel in various applications.

Sweat resistant apparel is clothing which is specially designed to minimize the effects of sweat by using various fabrics and technologies that help in moisture control and sweat absorption. These apparel items are widely used in various physical activities or hot weather conditions that help individuals provide comfort. The sweat-resistant apparel market is expanding rapidly due to the higher investments in various materials like polyester, nylon, merino wool and others that have moisture-wicking fabrics. The market is witnessing rapid advancements, which are helping consumers to provide odor control and enhance breathability.

The rising global temperature is one of the major drivers that is changing the consumer preferences for various apparel. For instance, the report by NASA also stated that 2024 was recorded as the warmest year on record, which is increasing rapidly due to rising human activities.

These activities are widely affecting the urban lands, which are playing an influential role towards the rising demand for sweat-resistant apparel. Individuals are preferring these clothes in their daily life as they sweat during normal activities, which leads to the use of this apparel in various professional and casual settings.

Many other factors, like maintaining health and hygiene that help individuals to avoid skin rashes and irritation. As a result, companies are rapidly spending on these apparel, which is attracting significant R&D for product innovations.

Industry Expert Opinion

| Report Attributes | Details |

| Market Size in 2025 | USD 226.48 Billion |

| Expected Size in 2034 | USD 343.89 Billion |

| Growth Rate | CAGR of 4.75% |

| Base Year in Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | North America |

| Segment Covered | By Product, By Material, By Consumer, By Price, By Distribution, By Region |

| Key Companies Profiled | Adidas, The North Face, Under Armour , Nike, Nosweat Clothing, Numi, Columbia Sportswear, Hanes, Lululemon, Mizuno, Neat, Oiselle, Patagonia, Social Citizen, Athleta |

Growing Popularity of Sustainable Products

The rising environmental concerns are leading towards significant changes in multiple industries, including apparel. The sweat resistant apparel market is anticipated to grow rapidly due to the rising government and regulatory push towards using apparel which are made from biodegradable and recycled materials. Many companies are also investing in these fabrics, which is helping them to boost their brand image. The younger populations, like Millennials and Gen Z, are also focusing on sustainability, which is marking major changes in their preferences. The rising use of active wear apparel is expected to play a major role in creating business in premium products. Global brands like Nike are also adopting initiatives like ‘Move to Zero, ’ which aims to reduce the carbon footprint and waste.

European Union(EU)- has introduced guidelines under Ecodesign for Sustainable Products Regulation (ESPR), which focuses on selling textiles which have met the eco-design standards, like durability and recyclability.

Lower Consumer Trust in Underdeveloped Economies

The majority of the premium apparel consumers are from urban areas, which maintains the product demand in these regions. The lower consumer understanding in the rural areas restricts them from purchasing sweat-resistant products, affecting the company's revenue. The lower social media influence also reduces the chances of digital marketing, which may also affect the growth. The sweat resistant apparel market may face certain challenges as global brands may not enter these regions due to lower ROI.

North America dominated the global sweat resistant apparel market by generating the highest revenue share in 2024. The dominance of the region is attributed to the higher disposable income, which makes a great business base for the companies. The population is also actively participating in physical activities due to increasing health awareness. Additionally, the region is also witnessing rapid investments in textile R&D, which would create more demand in the future.

U.S. Sweat Resistant Apparel Market Trends:

The United States stands as a dominant player in the North American market due to the presence of companies like Nike and Under Armour. These companies have a global presence, which creates global demand for multiple product lines. The country has a higher influence of gym-going population, which also helps towards the market growth.

Asia Pacific is anticipated to grow at the highest CAGR during the forecast period of 2025 to 2034. The growth of the region is attributed to the rising urbanization in countries like India and China, which attracts significant demand for active wear apparel. The rising social media presence also helps companies reach a wider population base through influencers. The production lines are also gaining significant investments due to lower manufacturing costs. Additionally, the stronger textile growth is anticipated to boost the supply chain on a global level.

India Sweat Resistant Apparel Market Trends:

India stands as one of the most promising countries in the Asia Pacific region. The rising health and wellness participation is playing a crucial role in creating a significant demand for sweat-resistant apparel. E-commerce is also expanding rapidly, which helps individuals access this apparel widely. Companies like Cultsport, HRX are widely expanding their portfolio through affordable pricing, which is helping them to expand their consumer base.

The top wear segment generated the highest revenue share in 2024. The dominance of the segment is attributed to the higher demand for products like t-shirts, polos, shirts and many more. Consumers are using these products regularly for various casual, formal and athletic wear. This creates multiple opportunities for the companies to expand their product offerings in different price ranges. Many companies are investing in fabric improvement for these products, which will help towards significant demand in the coming years. The rising consumer preferences towards comfortable clothing are also creating a wider business base for the companies.

The bottom wear segment is expected to rise at the highest CAGR during the forecast period of 2025 to 2034. The demand for various products like joggers, sweatpants, leggings and shorts is significantly increasing for various casual and athletic purposes. The rising health and fitness awareness is increasing the demand for articles of clothing in various activities like gym, jogging, cycling and running. The rising obesity cases in urban areas due to sedentary lifestyles also stand as a major factor which will continue to drive the demand for these products in the upcoming years. The demand for more breathability and flexibility in these settings is anticipated to create a wider consumer base for the companies.

The synthetic fabrics segment accounted for the largest revenue share in 2024. The demand for fabrics like polyester, nylon, and spandex is higher in the sweat resistant apparel market due to higher demand for quick-drying and moisture-wicking properties. These fabrics are witnessing significant demand in activewear due to their durability, which makes frequent washing easier. The consumer base of these products is also higher, which creates a mass production demand on the global stage. As a result, many companies are investing in innovating antibacterial and anti-odor products at affordable prices, which might help them grow their business at a faster rate.

The natural fabrics segment is anticipated to grow at the fastest CAGR during the forecast period of 2025 to 2034. The demand for these fabrics, like organic cotton, hemp, and bamboo, is witnessing a wider demand due to the changing consumer preferences towards biodegradable materials. The sweat resistant apparel market is anticipated to expand rapidly due to the rising focus on skin-sensitive clothes that protect from any rashes or skin infections. Many global brands are also adopting eco-friendly collections due improve their brand image through sustainable offerings.

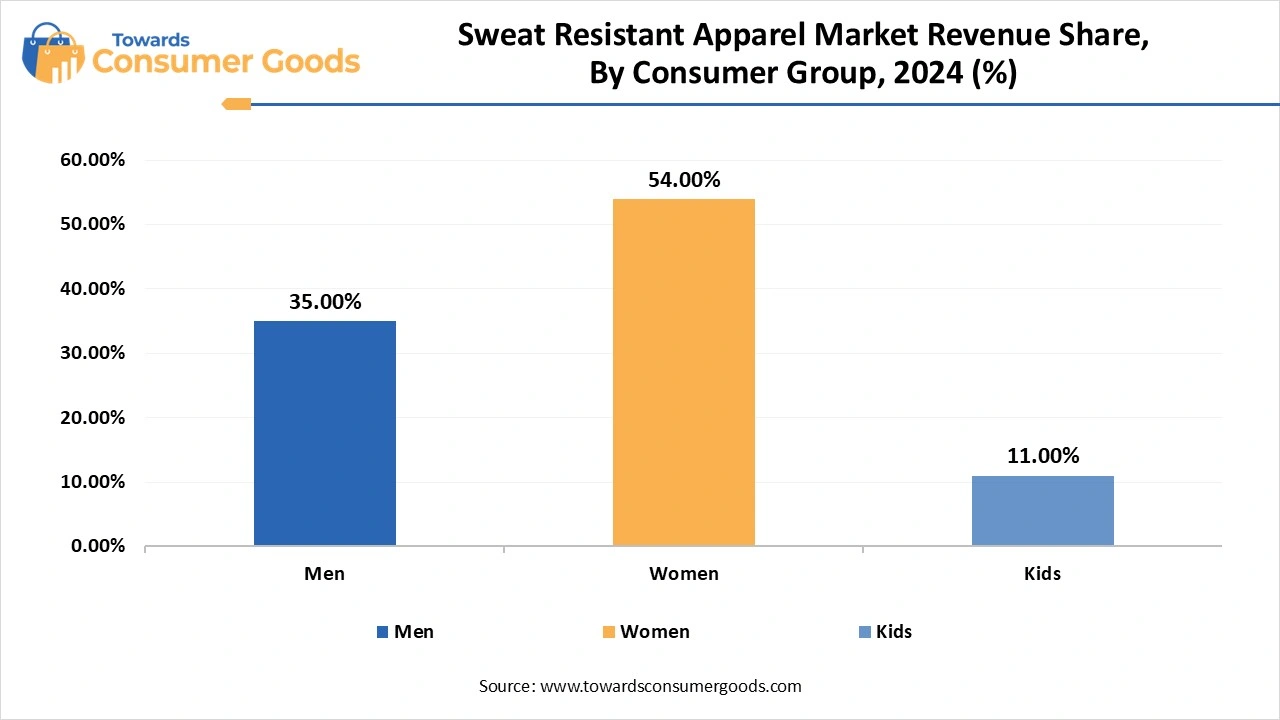

The women segment accounted for the largest revenue share in 2024. The majority of the revenue of the segment is attributed to the athleisure trends, which creates a rising competitiveness between the companies for functionality and styles. The sweat resistant apparel market is expanding rapidly due to the wider product offerings for travel, casual and daily wear. The companies are investing rapidly due to the rising engagement of females in physical activities that create more demand for various products like leggings, tops, sports bras and many more. The companies are using female celebrities to expand the market reach for the consumer base.

The men's segment is expected to rise at the fastest CAGR during the forecast period of 2025 to 2034. The growth of the segment is attributed to the rising health consciousness among males, which leads towards rising consumer spending. The Gen Z and Millennials are actively participating in sports activities and the gym, which creates a wider demand for companies. The companies are aiming to launch durable and comfortable products which will help in engaging a larger audience. The sweat resistant apparel market is also expected to grow due to the rising demand for moisture-absorbing and odour-controlling clothes in casual and professional settings.

The medium segment marked its dominance by contributing to the highest revenue share in 2024. These products target a wider consumer base in the developing regions due to the adoption of fitness and casual wear. These consumers are keen to invest in affordable and functional clothing, which can help them in the long run. As a result, many emerging companies are introducing various medium-priced apparel for these consumers. The rising frequency of these products is also expected to help companies' new products regularly.

The offline segment accounted for the largest revenue share in 2024. The demand for the segment is attributed to the consumer preferences for trial and purchase. This has led to the increasing physical presence of brand outlets in many regions. The sweat resistant apparel market is expanding rapidly due to the higher trust and reliability in offline stores, which can further initiate returns and exchanges instantly. These stores are increasing their presence in the growing economies which can help them in generating more business in the coming years.

The online segment is anticipated to emerge as the fastest-growing during the forecast period of 2025 to 2034. The rapid e-commerce expansion in countries like the US, China, Japan, and India is creating a wider demand in these regions. The changing lifestyles are also promoting online shopping, which provides convenient services to consumers. The sweat resistant apparel market is anticipated to grow more rapidly due to the rising digital presence of global companies, which maintain trust and reliability.

April 2025