March 2025

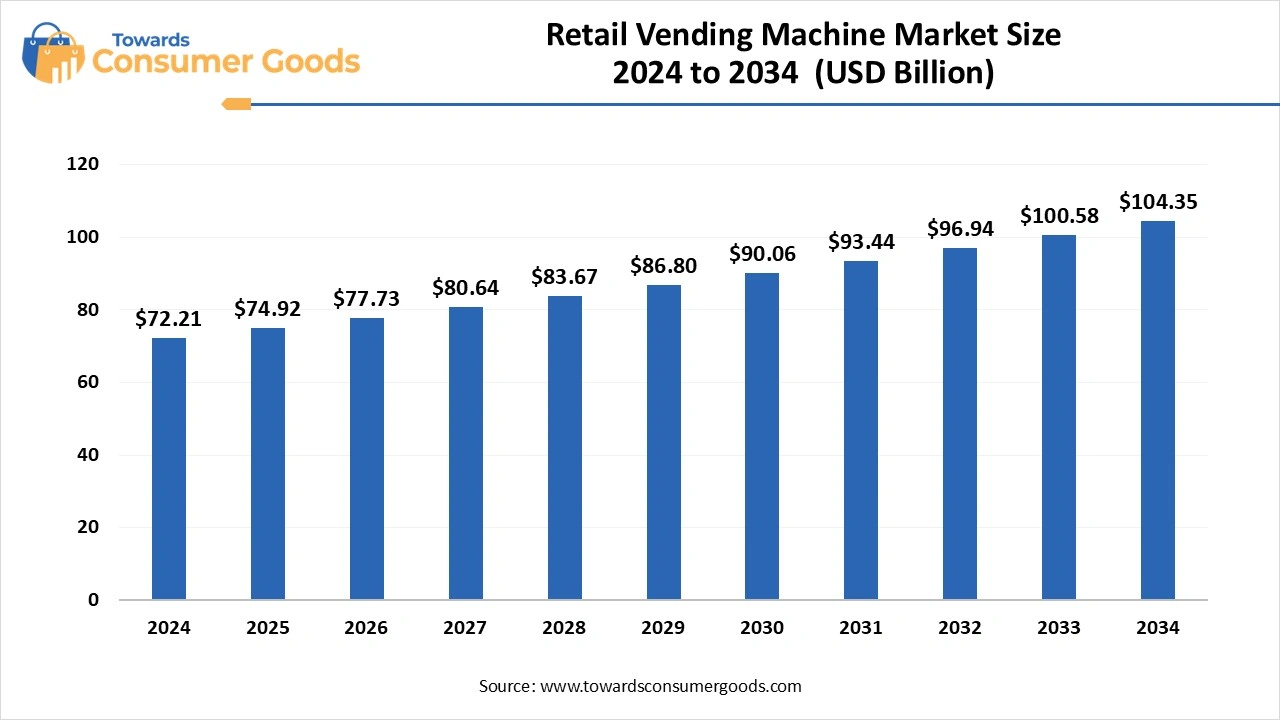

The retail vending machine market size was calculated at USD 72.21 billion in 2024 and is projected to hit around USD 104.35 billion by 2034 with a CAGR of 3.75%. The 24/7 availability and the convenience of purchasing snacks anytime have driven the market growth.

The retail vending machine market is a dynamic sector focused on enhancing consumer convenience and accessibility. These automated retail machines are designed to dispense a wide variety of products, such as snacks, beverages, personal care items, and even electronics, redefining the shopping landscape by providing out-of-store purchasing options. This market is propelled by rapid technological advancements and shifting consumer preferences, particularly in bustling urban environments where lifestyles demand quick and easy solutions.

Gone are the days when vending machines exclusively offered standard snacks and drinks; today’s machines feature an extensive array of products, including organic food items, premium cosmetics, and tech gadgets tailored to meet diverse consumer needs. The latest innovations include smart vending machines equipped with interactive touchscreens and personalized product recommendations. These machines utilize sophisticated real-time inventory management and facilitate seamless contactless payment options, making them increasingly favored by consumers.

Strategically positioned in high-traffic locations such as corporate offices, shopping centers, public transportation hubs, and recreational areas, these machines aim to provide exceptional convenience and accessibility. The retail vending machine sector is currently witnessing substantial growth driven by an upsurge in consumer demand for convenience, a rising preference for on-the-go purchasing solutions, and an emphasis on healthier food and beverage choices.

The integration of cutting-edge technologies like the Internet of Things (IoT) and cashless payment systems further enhances this growth, allowing vending machines to offer 24/7 access to products without the constraints of traditional retail store operating hours. This modern retail format perfectly caters to busy individuals who seek hassle-free shopping experiences. The widespread adoption of mobile wallets and near-field communication (NFC) technologies ensures that consumers can execute quick and easy payments without needing cash. In terms of technological capabilities, the incorporation of Internet of things (IoT) devices allows vending machines to boast features such as real-time inventory tracking, remote monitoring, and predictive maintenance, enabling more efficient operations and enhanced customer experiences.

| Report Attributes | Details |

| Market Size in 2025 | USD 74.92 billion in 2025 |

| Expected Size in 2034 | USD 104.35 billion by 2034 |

| Growth Rate | CAGR of 3.75% |

| Base Year in Estimation | 2024 |

| Forecast Period | 2025-2034 |

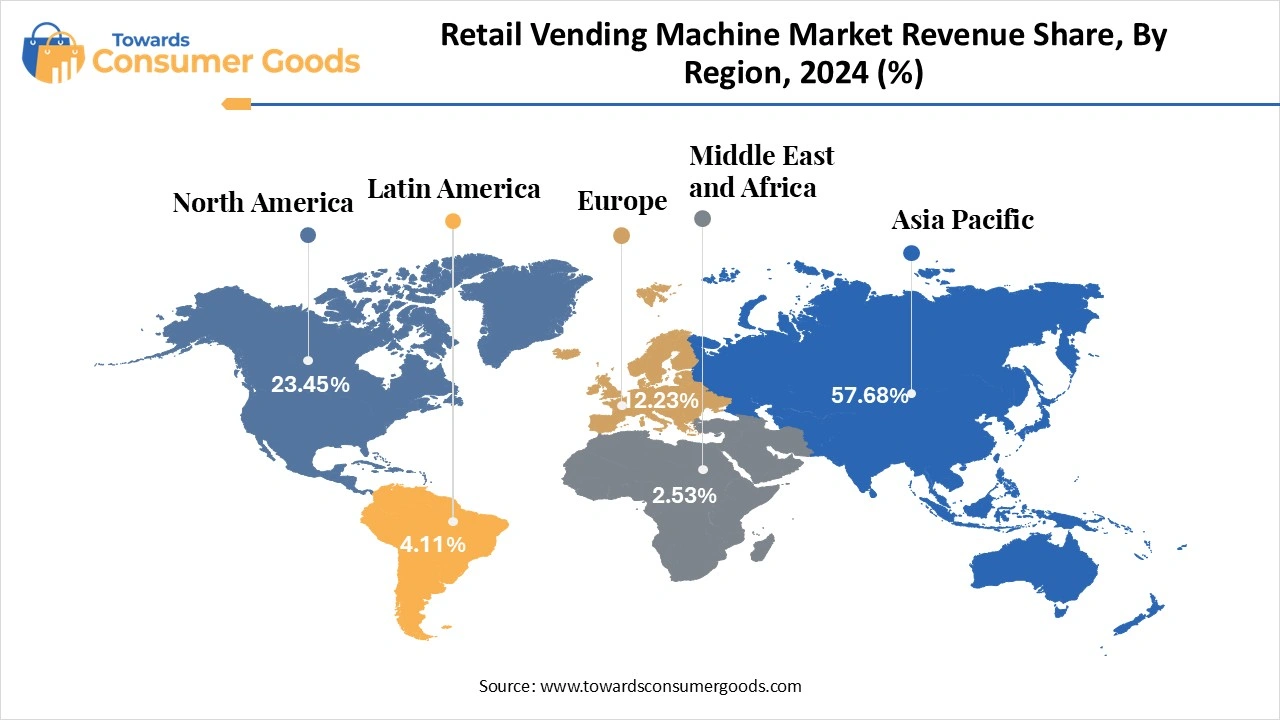

| Dominant Region | Asia Pacific |

| Segment Covered | by Product, by Location, by Payment Mode, by Regional |

| Key Companies Profiled | Azkoyen Group,Westomatic Vending Services Limited,Royal Vendors, Inc.,Glory Ltd.,Sanden Holding Corp.,Seaga Manufacturing Inc.,Orasesta S.p.A,Sellmat s.r.l.,Fuji Electric Co., Ltd.,Selecta Group,Express Vending,DGA Vending GmbH |

The vending machines offered by Daalchini feature an extensive array of products, ranging from snacks and beverages to personal care items and even tobacco products. These machines are equipped with state-of-the-art technology, incorporating software solutions, vibrant LED lighting, and convenient cashless payment options. Vending machines serve as on-demand retail solutions, particularly valuable in high-traffic locations like airports, shopping malls, and office complexes, addressing the needs of busy consumers seeking quick access to refreshments.

In addition to typical snacks and drinks, there is a noticeable trend towards offering fresh food, healthier snack options, premium coffee selections, and specialty items through these machines, aligning with changing consumer preferences. Smart vending machines are further enhancing the customer experience by integrating features such as cashless payments, touchless user interfaces, and artificial intelligence systems designed to boost operational efficiency and customer service. Some market players are also embracing environmentally sustainable practices by using eco-friendly materials, minimizing energy consumption, and introducing machines designed with recycling capabilities.

Despite the promising opportunities within the retail vending machine sector, there are notable market constraints. A primary challenge is the high initial investment involved, including substantial costs for hardware, software, and ongoing maintenance, which can deter business owners, especially those running smaller operations. Moreover, vending machines come with limited physical space, restricting the variety of products that can be offered. This limitation poses a significant disadvantage compared to traditional retail outlets, which provide a far more extensive selection of goods. Additionally, there are risks associated with fraud and vandalism that operators must consider when deploying vending machines.

The beverage segment plays a pivotal role in dominating the retail vending machine market, fueled by various key factors. An increasing consumer inclination towards convenient, on-the-go refreshments has driven demand for these machines. This trend is supported by significant advancements in vending technology, such as sleek interfaces and improved inventory management systems, enhancing user experience and operational efficiency. Furthermore, there is a growing societal shift toward healthier beverage options, which extends beyond traditional soft drinks to encompass choices like flavored waters, organic juices, and functional beverages rich in vitamins and electrolytes. For businesses, vending machines represent a cost-effective strategy for providing employees and customers with readily available beverage options, particularly when compared to the complexities and overhead of traditional retail spaces.

On the other hand, the snacks segment has emerged as the fastest-growing area within the retail vending machine market, driven by several interconnected trends. There is a marked rise in demand for convenient snack options, particularly among urban dwellers who lead fast-paced lifestyles and seek quick, accessible food choices. This shift has led to the introduction of nutritious options, such as energy bars, baked chips, and even fresh produce like fruits and vegetables. Vending machines are evolving in response to this trend, now offering a diverse array of healthy snacks, including yogurt and nut mixes, to cater to the growing preference for better-for-you snacking alternatives.

From a location-based perspective, the manufacturing segment is a primary leader in the retail vending machine landscape. This dominance is driven by the necessity for efficient management of tools, parts, and supplies within fast-paced manufacturing environments. Additionally, industrial vending machines play a critical role in managing essential materials, equipment, and personal protective gear (PPE), thereby reducing waste and improving overall accountability within manufacturing facilities.

Conversely, the public places segment is emerging as the fastest-growing category in the retail vending machine market, spurred by heightened consumer demand for convenience and on-the-go access to products. These machines facilitate quick, cashless transactions that alleviate the need for staffed retail outlets and streamline the purchasing experience. Adaptable to various product offerings, vending machines can cater to a wide spectrum of customer preferences, ensuring a diverse and satisfying selection.

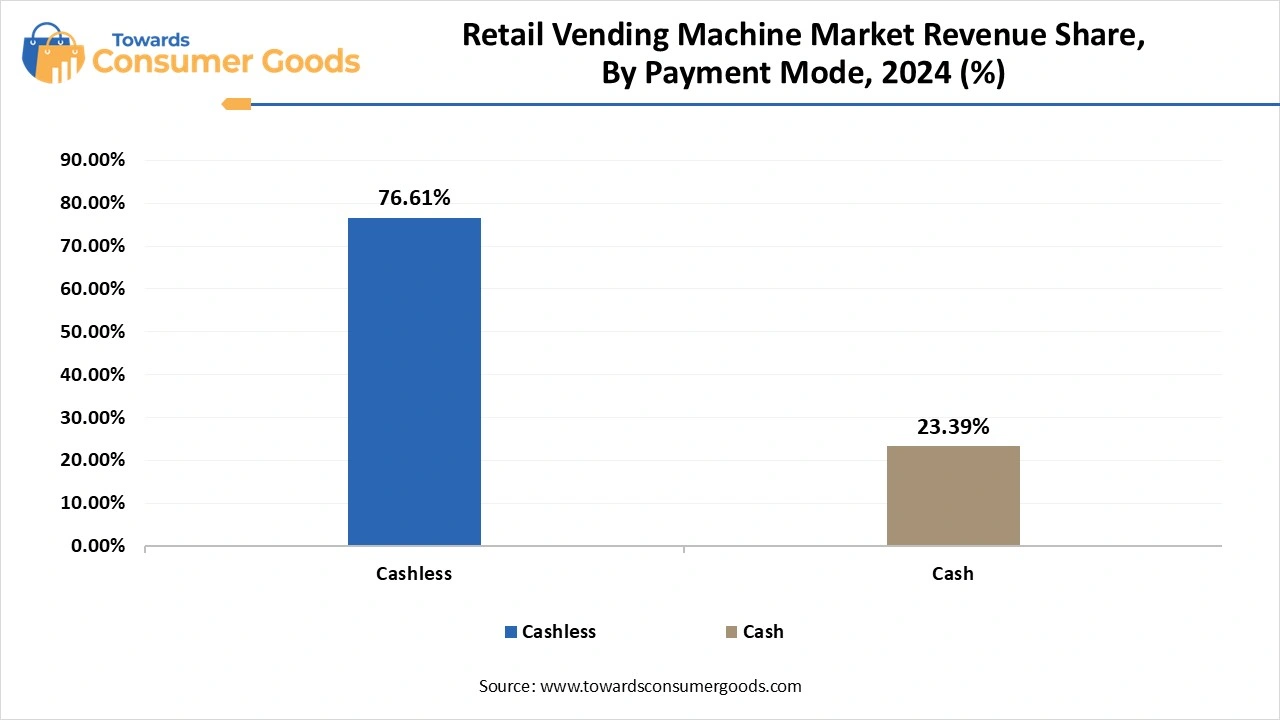

In terms of payment options, cashless transactions have swiftly taken the lead in the retail vending machine market. This shift is largely attributed to consumer preferences for convenience, speed, and the increasing reliance on digital payment methods, which have been significantly enabled by the widespread use of smartphones and digital wallets.

The proliferation of mobile payment platforms and contactless payment technologies has made cashless options more appealing to consumers, who appreciate the enhanced security features, such as minimized risks of theft or fraud that come with relying on cash.

While cash transactions still maintain a considerable presence within the market, they are no longer the fastest-growing segment; the heightened consumer preference for the swift, safe, and convenient experiences provided by cashless payments reflects an undeniable trend toward modernization in vending transactions.

The Asia-Pacific region stands as the leader in the retail vending machine market, driven by significant factors including high adoption rates in nations like Japan, China, and South Korea. These countries are experiencing rapid urbanization and benefit from a youthful population coupled with substantial investments into the sector. Notably, India plays a pivotal role in this regional dominance, particularly in urban centers where corporate environments thrive. The market in India is expected to grow further, bolstered by investments aimed at improving public infrastructure and organized retail frameworks.

China is a formidable presence in the global vending machine space, boasting a rapidly expanding market characterized by automation and innovative digital solutions. Chinese manufacturers are leading the charge in the adoption of AI-powered vending machines, seamless digital payment integration, and even advanced robotic systems for in-machine food preparation.

North America emerges as the fastest-growing segment in the retail vending machine arena, attributed to a strong consumer demand for convenience and the swift embrace of smart vending technologies. Within this region, the United States serves as the dominant force, although Canada is also making significant strides, contributing to market expansion through an increase in vending machine presence in the travel and leisure sectors.

Canada’s market expansion is further stimulated by the adoption of smart vending technologies, such as touchscreen interfaces and mobile payment capabilities, all aimed at delivering a more streamlined and customer-friendly experience.

Bummer

Innovation- In a groundbreaking move to enhance the convenience of shopping for personal items, modern Indian direct-to-consumer innerwear brand Bummer unveiled India’s pioneering vending machines in November 2024. These machines are designed to simplify the purchasing process for innerwear, allowing consumers to shop as effortlessly as they would when buying a bottle of water.

Acton Academy

Entrepreneurship- In March 2025, an enterprising 13-year-old student named Crosby Wills from Acton Academy Placer in Sacramento took the initiative to install and operate a vending machine at a local laundromat, showcasing youthful entrepreneurship in the vending market.

Asda

Integration of Technology- In February 2024, grocery giant Asda launched an innovative digital in-store vending machine while simultaneously ramping up its retail media strategies. This new initiative, dubbed Asda Access, aims to leverage technology for better customer connections and brand engagement through digital touchpoints, ensuring that marketing campaigns yield effective returns on investment and enhance overall customer satisfaction.

March 2025