April 2025

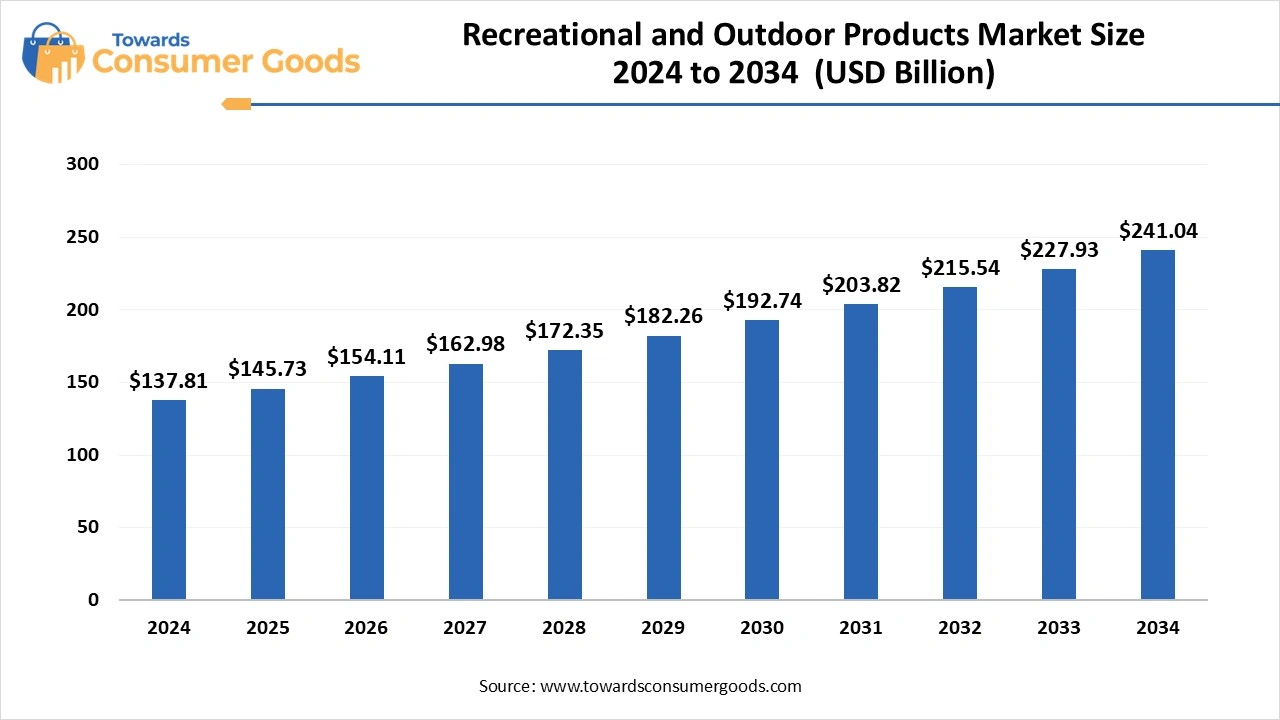

The global recreational and outdoor products market size is calculated at USD 137.81 billion in 2024, grew to USD 145.73 billion in 2025, and is projected to reach around USD 241.04 billion by 2034. The market is expanding at a CAGR of 5.75% between 2025 and 2034. The demand for recreational and outdoor products is increasing due to increasing health and fitness awareness among individuals in urban areas.

The recreational and outdoor products are equipment, gear and goods specially designed for various fitness and adventure activities suited or outdoor environments. These products cover various pursuits like water sports, fishing, hiking and camping. The recreational and outdoor products market is expanding at a rapid pace due to the rising outdoor activities that require comfortable and suitable accessories and gear, according to the use.

These products are also used to protect individuals from adverse weather conditions during these activities. The changing lifestyle patterns are increasing the physical participation of individuals, which is helping towards the market growth.

The rising youth engagement in outdoor activities is one of the major drivers which is playing a transformative role in educating and entertaining the younger generation. The growing youth population in developing countries stands as a major factor, where they are engaging in these activities more frequently.

| Report Attributes | Details |

| Market Size in 2025 | USD 137.81 Billion |

| Expected Size in 2034 | USD 241.04 Billion |

| Growth Rate | CAGR of 5.75% from 2025 to 2034 |

| Base Year in Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | North America |

| Segment Covered | By Product, By Price, By End Use, By Distribution Channel, By Region |

| Key Companies Profiled | Clarus,Columbia Sportswear,Deckers Outdoor,Foot Locker,Garmin,Johnson Outdoors,Marmot,The North Face,Topgolf Callaway Brands, Wolverine Worldwide,Newell Brands,Patagonia,REI,Sporting Goods Corporation,Yeti |

The rapid integration of technologies like Internet of Things (IoT), solar-powered backpacks and many more are playing a transformative role, which will help the market grow in the upcoming years. The rising integration of GPS-enabled smartwatches is raising the adoption due to the health monitoring capabilities in real-time.

The rising technological adoption is also leading towards advanced features in the tents like lighting, climate control and many more. The recreational and outdoor products market is also anticipated to gain more popularity due to the growth of mobile applications that provide help with trip planning, route optimizations and many more.

For example, ‘Strava’, a mobile-based application, helps with ride tracking, finding outdoor activities and many more. The growing popularity is also expanding their functionalities in activities like biking, running, trekking and many more.

Lower supply and Demand in underdeveloped regions (restraint)

The outdoor products have gained significant demand in the developed and developing regions due to higher consumer understanding. The recreational and outdoor products market may face certain challenges in the underdeveloped regions due to lower disposable incomes that restrict them from purchasing these products. The companies may also face certain challenges while entering these regions in the initial years. Additionally, the cultural barriers in these regions also restrict the demand for activities like hiking, trekking, and many more.

North America dominated the global recreational and outdoor products market by contributing the largest revenue share in 2024. The region's dominance is attributed to the rising outdoor activities in countries like the United States and Canada. The companies in the region are also introducing premium products due to the rising disposable incomes in these countries. The rising popularity of snow sports is also increasing the demand within companies for more advanced products.

The United States stands out as a major player due to rising investments in outdoor infrastructure that are promoting activities like hiking, fishing, camping and many more. The government also takes initiatives to preserve and maintain these recreational spaces.

For instance, the National Park Service cares for more than 400 parks in the country. The recreational and outdoor products market is expected to rise, as activities that contribute towards the country's economy. For instance, the outdoor recreational economy of the country accounted for $ 639.5 billion, which equals 2.3 per cent of GDP.

Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period of 2025 to 2034. The region's growth is attributed to rising urbanization, which is promoting outdoor activities in countries like Japan, India, and China. Additionally, tourist attractions are also adopting these activities, which contribute to the region’s economy.

The growing popularity of outdoor trekking and wildlife safaris in countries like India is playing a major role in attracting a significant audience. The corporate companies in the region are also promoting outdoor activity-based events, which is helping to raise the popularity.

China is one of the prominent players in the Asian market due to its stronger presence of manufacturing capacities. The recreational and outdoor products market is anticipated to grow rapidly due to the rising popularity of sports in the country. The Chinese government is also investing heavily in these sports, which helps them in securing a vital role in the global production and sales.

The camping and hiking equipment segment accounted for the largest revenue share in 2024. The dominance of the segment is attributed to the rising popularity of adventure tourism, especially in the urbanized areas. The recreational and outdoor products market is expanding rapidly as companies are getting more business opportunities to expand their portfolio in segments like tents, sleeping bags, navigation tools, backpacks and other portable cooking equipment. The rising popularity of tourism is attributed to the government initiatives that are aiming to preserve national parks to boost their economy. The rising public-private partnerships are also anticipated to play an influential role in the upcoming years.

The sports and outdoor gear segment is expected to rise at the fastest CAGR during the forecast period of 2025 to 2034. The rising influence of social media platforms is playing a vital role in increasing the popularity of these activities. The recreational and outdoor products market is anticipated to grow rapidly due to rising social gatherings in the urban areas, which are promoting activities like yoga, cycling, callisthenics and many more.

These initiatives are also helping to generate employment in the sports industry through online platforms. The rising technological adoption in these activities is expected to raise the demand for smart functions like GPS tracking, fitness wearables and many more.

The medium segment accounted for the largest revenue share in 2024. The dominance of the segment is attributed to the wider consumer base that targets the growing middle-class population. The recreational and outdoor products market is expanding rapidly due to the higher consumer understanding of quality-based products. As a result, the companies are introducing products in this price range, which helps them in targeting a wider population. Companies like Decathlon, Columbia and many more are expanding their services in the developing regions, which is expected to help them in the long run.

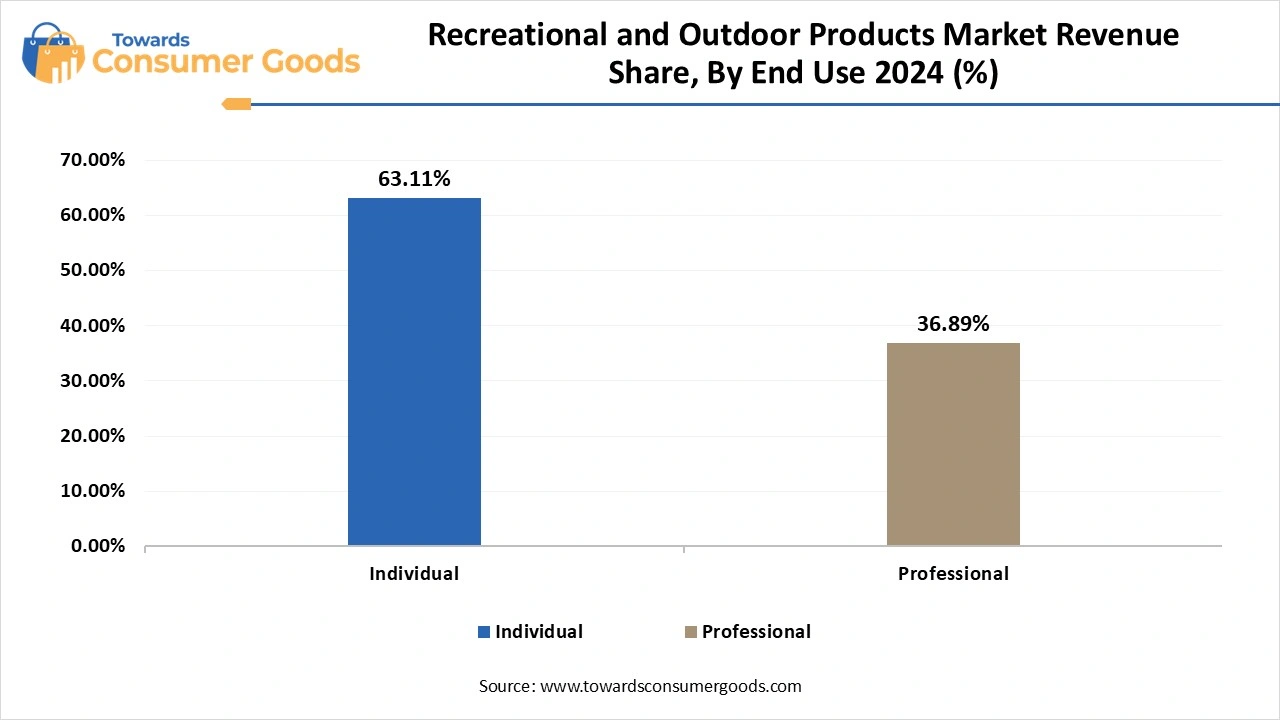

The individual segment accounted for the highest revenue share in 2024. The dominance of the segment is attributed to the growing trend of solo travelling on social media platforms. Individuals are investing in these products due to the increasing personal use. Additionally, these products usually target a single person, which makes them more affordable for individuals. The rising urbanization trends are leading towards the introduction of these products in the market, which are gaining significant popularity.

The professional segment is anticipated to rise at the fastest CAGR during the forecast period of 2025 to 2034. The rising outdoor participation of the youth population is helping the segment grow at a rapid pace. The recreational and outdoor products market is anticipated to gain more popularity due to the rising investments from sports organizations that are purchasing these products in larger quantities.

The offline segment marked its dominance by generating the highest revenue share in 2024. The dominance of the segment is attributed to the wider consumer base that prefers physical purchases due to various factors like trust and reliability. Additionally, these purchases provide hands-on experience, which allows you to try these products like bicycles, hiking boots, and many more. These stores also have expertise which helps them in selecting the best products according to the consumer preferences. The popularity of these channels is increasing more widely due to the immediate availability of these products in the stores.

The online segment is observed to grow at the fastest CAGR during the forecast period of 2025 to 2034. The recreational and outdoor products market is anticipated to gain more popularity due to the rising digitilization that promotes e-commerce platforms.

These online channels provide a wider product range with home delivery options, which makes it more convenient for individuals in urban areas. The rise of AI, AR/VR and other technologies is expected to help the market grow more rapidly in the upcoming years.

By Product Type

By Price

By End Use

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025