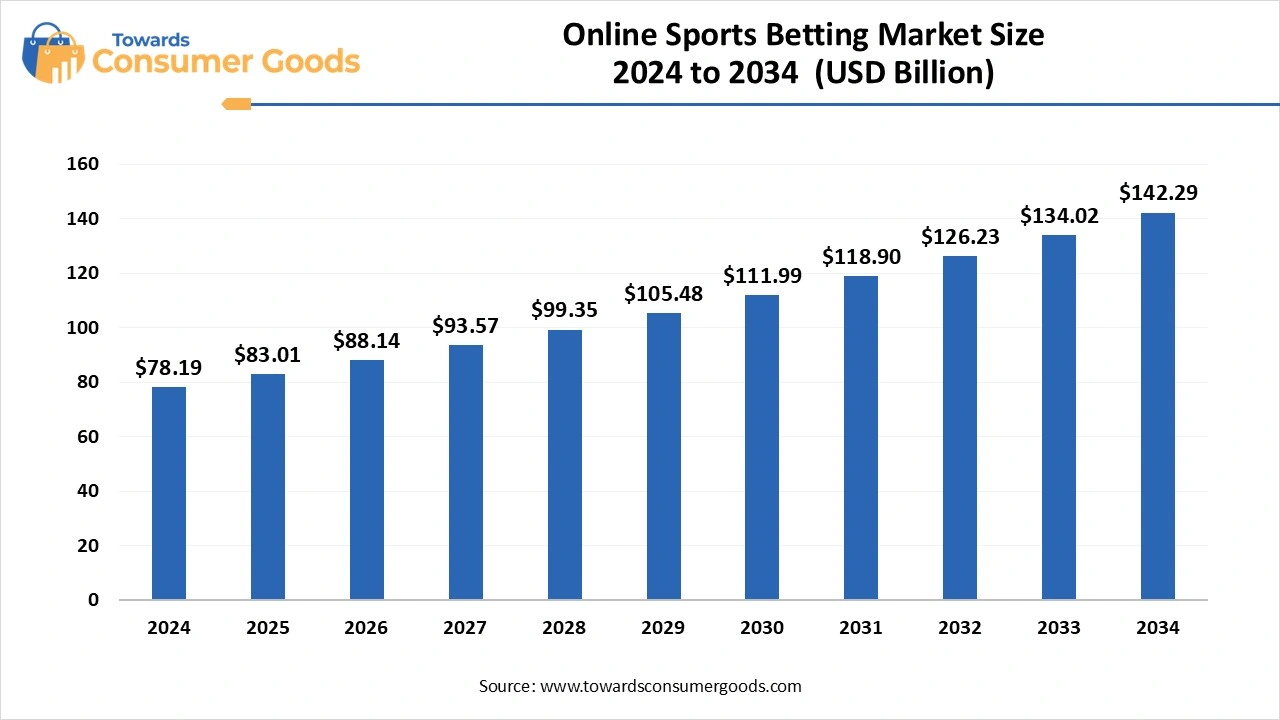

The global online sports betting market size was estimated at USD 78.19 billion in 2024 and is predicted to increase from USD 83.01 billion in 2025 to approximately USD 142.29 billion by 2034, expanding at a CAGR of 6.17% from 2025 to 2034.The rapid adaptation of digital technology and gadgets and the legalization of betting games have driven the market growth.

The online sports betting market is intrinsically linked to the art of predicting outcomes in sporting events and subsequently placing wagers on those predictions via various online platforms. At its foundation lies an extensive variety of sports across which bets can be placed, encompassing globally celebrated games such as football, basketball, cricket, and baseball. The market thrives on the thrilling unpredictability and fan engagement associated with these events, and major tournaments and leagues significantly amplify betting activity. At its essence, online sports betting entails wagering on numerous facets of a sporting event. These wagers can encompass predictions of the outcomes, as well as more granular aspects, including the total number of goals scored, the identity of the first player to find the net, or the individual performances of specific athletes.

The online sports betting market is currently experiencing robust growth, driven by a myriad of factors that enhance accessibility, user experience, and overall market reach. Notable among these are the increasing penetration of the internet and smartphones. The widespread availability of high-speed internet, combined with the global upsurge in smartphone adoption, facilitates easy access to online betting platforms, thereby engaging a larger demographic. For example, the global number of smartphone users is on a steady incline, making mobile betting a dominant and pivotal segment in this market. Enhanced digital infrastructure, coupled with improved wireless connectivity, has rendered seamless and convenient betting experiences possible for users engaging on the go. Furthermore, the growing popularity of both traditional sports and esports is a vital contributor to this market’s expansion.

The increased interest in popular sports such as football, cricket, and basketball is accompanied by rising disposable incomes, encouraging greater participation in online sports betting. Additionally, the meteoric rise in viewership and engagement levels within the esports domain has unveiled a substantial new market segment ripe for online betting. This observable trend suggests that the sports betting market is likely to witness accelerated growth.

| Report Attributes | Details |

| Market Size in 2025 | USD 6.43 Billion |

| Expected Size in 2034 | USD 10.14 Billion |

| Growth Rate | CAGR of 5.20% from 2025 to 2034 |

| Base Year in Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | North America |

| Segment Covered | by betting Type, by Device Type, by Sports Category, by Payment Method, by Regional |

| Key Companies Profiled | Bet365,Amaya Gaming,Betsson AB,Paddy Power,Flutter Entertainment,Entain,William Hill,Kindred Group,DraftKings,Caesars Entertainment,GVC Holdings,Sky Betting and Gaming,888 Holdings,MGM Resorts International |

The market for online sports betting holds a plethora of promising opportunities for expansion and innovation. For instance, incorporating high-quality live streaming of sporting events directly into betting platforms not only enriches the in-play betting experience but also significantly boosts user engagement and increases overall betting volumes. Moreover, the integration of blockchain technology can enhance the transparency and security of transactions. Utilizing cryptocurrency offers users quicker, and potentially more discreet, payment methods, appealing particularly to a niche segment of the betting community. As mobile devices dominate the gaming landscape, the continual enhancement of mobile app design, user interfaces, and added features becomes critical to staying competitive and meeting user expectations.

However, several market constraints pose challenges to the growth of online sports betting. The legality and regulations surrounding online sports betting can vary significantly not only between countries but also within different states and regions of the same country. Securing and retaining licenses in regulated markets can become a costly and time-consuming endeavor. Operators are burdened with numerous compliance requirements, including those related to anti-money laundering, KYC protocols, and responsible gambling practices, which inevitably raise operational costs. Additionally, the legal framework governing online betting is in a constant state of flux; therefore, operators must remain vigilant and prepared to adjust their practices in response to new rules and interpretations that emerge over time.

The fixed-odds betting segment has emerged as the leading player in the market, capturing the largest market share. This type of betting allows gamblers to place wagers at predetermined odds, giving them a reassuring sense of control and clarity regarding their potential returns. As technology has evolved, the user experience has seen significant enhancements, with online and mobile betting platforms making fixed-odds wagering increasingly convenient and accessible.

Meanwhile, the exchange betting segment is poised for the most rapid growth during the upcoming forecast period. This anticipated surge is largely fueled by the widespread availability of smartphones and reliable Internet access, which collectively make online betting more attainable for a broader audience. Additionally, the ongoing legalization and regulation of online betting in various regions and countries are creating new markets and attracting a growing number of users eager to engage in this form of entertainment.

In the realm of device types, desktop platforms dominate the market, holding the largest share. The advantages of desktop betting include larger screens, superior graphics, and more intricate layouts, all of which significantly enhance the user's ability to analyze crucial statistics, observe odds movements, and navigate between multiple betting markets with greater ease than smaller mobile screens. Desktops allow users to open several tabs simultaneously, making it simple to compare odds across various bookmakers or exchanges, research team and player statistics, and utilize betting calculators all at once.

Conversely, the mobile segment is projected to experience the fastest growth throughout the forecast period. The convenience of being able to place bets anytime and anywhere on smartphones and tablets serves as a significant driving force behind the increasing allure of mobile betting, especially among casual gamers. With advancements in mobile Internet speeds, improved graphics performance on smartphones, and the development of user-friendly betting applications, the mobile betting experience is continuously evolving and becoming more enjoyable.

Within the sports category, football stands out as the dominant segment, capturing the largest market share. A substantial percentage of the global population actively engages with football, whether by watching games, following teams, or placing bets, far surpassing interest in other sports. Football matches are widely televised and streamed online, allowing fans to easily keep track of their favorite teams and players, which in turn encourages betting activities. Furthermore, the proliferation of mobile betting apps has made wagering on football remarkably convenient, empowering users to place bets from virtually anywhere at any time.

On the other hand, the basketball segment is anticipated to grow at the fastest pace during the forecast period. The sport's continuous action, frequent scoring opportunities, and potential for dramatic momentum shifts render it exceptionally engaging for live in-play betting, a rapidly expanding segment of the market. The global recognition of basketball stars enhances fan engagement and subsequently piques betting interest. Additionally, the compelling narratives and rivalries inherent in basketball contribute to its widespread appeal. The availability and analysis of basketball statistics also empower bettors to make more informed wagering decisions.

When it comes to payment methods, credit and debit cards hold the largest share in the market. These cards have long served as the primary tools for online transactions due to their widespread acceptance. A significant portion of the adult population around the world possesses and regularly utilizes credit and debit cards, making them the default option for online betting. Depositing funds into online betting accounts using these cards is generally a straightforward and quick process, as users simply enter their card details—a process that betting sites have worked to streamline for added convenience.

In contrast, the e-wallets segment is projected to witness the fastest growth over the forecast period. Services such as PayPal, Skrill, and Neteller offer a layer of security by acting as intermediaries between the bettor's bank account or card and the betting site. Transactions involving e-wallets—both deposits and withdrawals—tend to be significantly faster than traditional methods, such as bank transfers or even card withdrawals. Instant deposits enable users to place bets immediately, which is especially essential for live betting scenarios, while quicker withdrawal processes provide faster access to winnings, enhancing the overall gaming experience.

In terms of regional dynamics, North America currently holds a dominant position in the online sports betting landscape. The region is characterized by a vibrant and passionate sports culture, with major leagues such as the NFL, NBA, NHL, and NCAA sports capturing the imaginations of millions and drawing substantial viewership. High internet penetration rates and widespread adoption of smartphones and mobile devices offer a solid framework for online betting platforms. Additionally, advancements in technological spheres—such as mobile gaming, live streaming services, and enhanced user interface designs—further elevate the betting experience, attracting a more tech-savvy audience.

In North America, sports betting operators engage in aggressive and innovative marketing tactics, including partnerships with significant sports leagues and teams, celebrity endorsements, and enticing promotional offers aimed at acquiring and retaining customers. Notably, Canada has also made significant strides in the legalization of online sports betting at the provincial level, contributing to this dynamic market landscape.

Conversely, the Asia-Pacific region stands out as the fastest-growing segment of the online sports betting market. Home to a large share of the global population, this region is witnessing a rapid increase in both internet and smartphone users, thereby creating a vast and expanding customer base for online betting platforms. The significant growth in esports viewership and participation has cultivated a burgeoning new market for betting. Furthermore, the liberalization of gambling regulations in specific locales like Macau and Hainan Island in China is paving the way for exciting new growth opportunities.

Other countries across the region are also contemplating the potential advantages of regulating online betting, which include increased tax revenues and enhanced consumer protections. Given the high mobile phone penetration rates in the Asia-Pacific area, mobile devices serve as the primary means of internet access for a considerable proportion of the population.

X Games

Initiative- In a noteworthy development, January 2025 saw the X Games initiate regulated sports betting in collaboration with Alt Sports Data. Over the past year, the X Games has enjoyed a remarkable 113% increase in streaming audiences, accompanied by the addition of 2.4 million new followers across its social media platforms.

Brazilian Government

Legalization- In December 2024, the Brazilian Government unveiled a comprehensive list of 136 authorized brands set to operate within the realms of sports betting and iGaming in Brazil. The Prizes and Betting Secretariat (SPA) of the Brazilian Ministry of Finance published 16 ordinances in the Official Gazette of the Union, detailing these companies that will be permitted to commence operations starting January 1, 2025.

Monumental Sports Network (MNMT)

Innovation- In February 2025, Monumental Sports Network (MNMT) announced that its state-of-the-art streaming application, Monumental+ (M+), powered by ViewLift, will integrate real-time sports betting odds and gamification options during live game streams for prominent teams such as the NHL’s Washington Capitals and the NBA’s Washington Wizards, facilitated by their innovative "Monumental Game Center" feature.” feature.

By Betting Type

By Device Type

By Sports Category

By Payment Method