April 2025

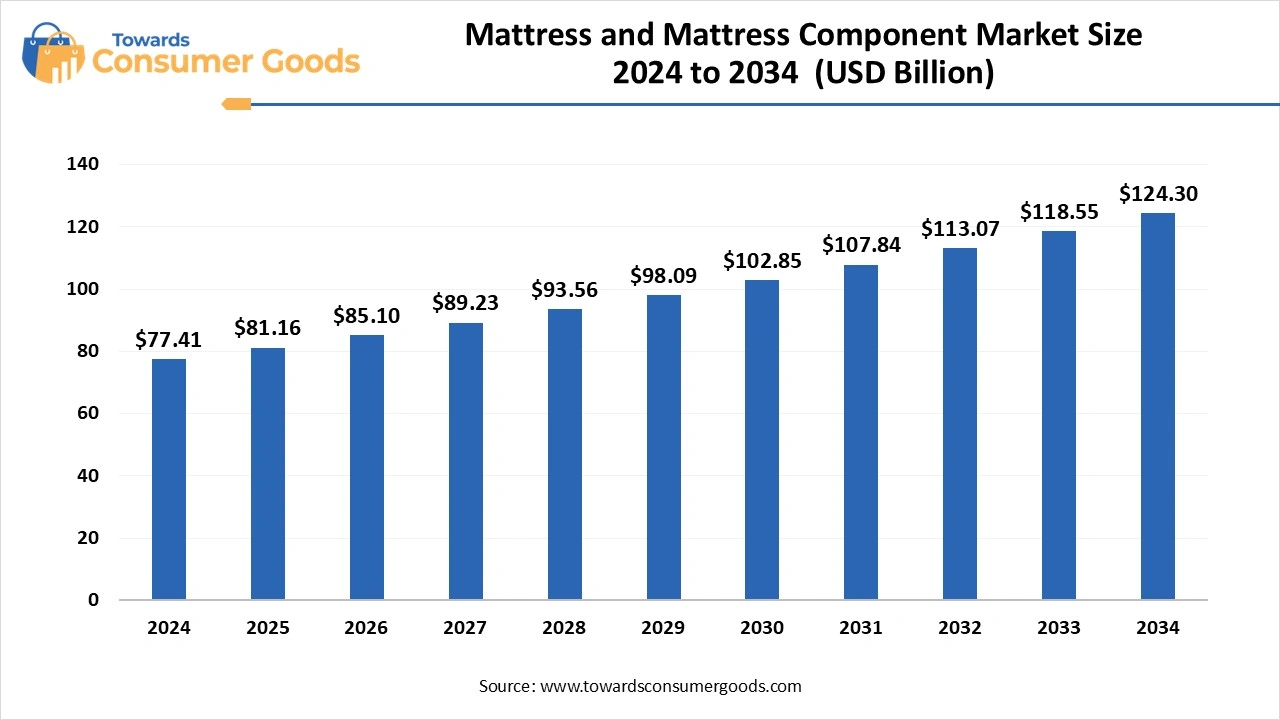

The mattress and mattress component market accounted for USD 77.41 billion in 2024 and is expected to reach around USD 124.30 billion by 2034, with a CAGR of 4.85% from 2025 to 2034.The demand for mattresses and their components is increasing due to the rising consumer wellness awareness, which helps in improving the overall health.

A mattress refers to a bed frame which uses rectangular pads to provide support to the body. It stands as an essential product in recent times as it helps in maintaining spinal alignment and providing comfort to individuals. Mattress components refer to the materials and elements used in the mattress that contribute to various aspects to improve the comfort and durability of the mattress.

The mattress and mattress component market is gaining significant popularity due to the increasing consumer base that is helping in the product demand, which includes various components like fabrics, materials and many more.

The rapid growth of the real estate and hospitality sector is one of the major drivers that has managed to attract significant revenue in the market. The rising urbanization has led to a rapid increase in the growth of residential constructions like apartments. The individuals are also spending on homes, which is attracting significant opportunities in the mattress and mattress component market.

Additionally, the tourism sector has also witnessed a rapid increase over the past few years since the outbreak of Corona coronavirus.

| Report Attributes | Details |

| Market Size in 2025 | USD 81.16 billion in 2025 |

| Expected Size in 2034 | USD 124.30 billion by 2034 |

| Growth Rate | CAGR of 4.85% |

| Base Year in Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | by Product Type, by Component Type , by Size, by Price, by End Use, by Region |

| Key Companies Profiled | Ashley Furniture Industries,DreamCloud,Hästens,Helix Sleep,IKEA,Kingsdown,Leggett & Platt,Simmons Bedding Company,Sleep Number Corporation,Purple Innovation,Relyon,Saatva,Serta Simmons Bedding,Stearns & Foster,Tempur Sealy International |

The technological integration in the consumer goods industry is playing an influential role in enhancing the functionality and popularity of products, including mattresses. The technologies have enabled the innovation of ‘smart mattresses’ that include sensors which monitor the individual’s sleep schedule and quality. These factors are gaining significant popularity due to the rising health consciousness among consumers.

The mattress and mattress component market is expected to expand rapidly due to the rising aging population, which helps in the adoption of these mattresses in the home and hospital settings. The rising disposable income in many regions is also leading towards an increase in spending on these mattresses. Moreover, the rising luxury homes are also integrating in build smart devices and products to boost their lifestyles.

The manufacturing of mattresses is increasing rapidly due to the higher demand in the overall market. The production requires many materials like polyurethane foam, memory foam, latex, springs, textiles and many more. The global shortage of these materials is also affecting the demand for the chemicals and their prices. The rising tariffs in recent years are playing a restraining role in the mattress and mattress component market. These factors are leading towards the increasing cost of the overall products that would hamper the consumer base adversely.

Asia Pacific dominated the global mattress and mattresses market by generating the highest revenue share in 2024. The dominance of the region is attributed to the rising urbanization in countries like India and China. These countries also dominate in the list of global population, which increases the business scope in the region. The companies are introducing various products that cater the individual demand at an affordable price. Additionally, tourism is also witnessing rapid growth in countries like Thailand, China, and Japan, which is boosting the growth more rapidly.

China stands as the prominent player in the mattress and mattress component market due to the presence of leading manufacturing companies of materials and products. The lower manufacturing costs are also the main factor that is increasing the export businesses in the country. The technological capabilities and adoption in the region are expected to boost the demand for smart products in the region.

North America is anticipated to grow at the fastest CAGR during the forecast period of 2025 to 2034. The growth of the region is attributed to the rising popularity of smart mattresses in countries like the United States and Canada. The individuals are also becoming health-conscious, which gives a significant business base for the emerging companies in the region.

The United States stands as the region’s leading country in the mattress and mattress component market due to the higher disposable income in the country. The individuals are preferring these products due to the growth of D2C platforms, which are making premium products affordable for individuals. The companies in the region also have access to advanced manufacturing infrastructure like robotics and Artificial Intelligence (AI), which is anticipated to play a vital role in the upcoming years.

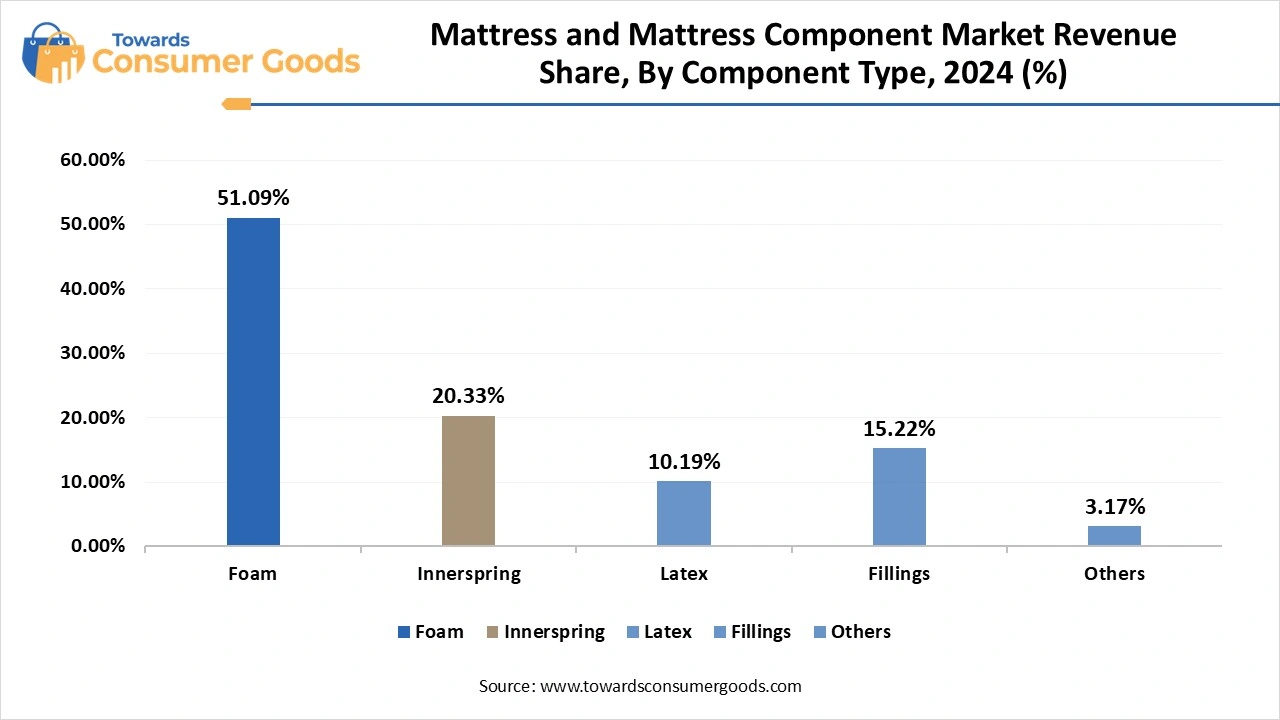

The foam mattress segment generated the highest revenue share in 2024. The dominance of the segment is attributed to the affordability of foams like Polyurethane, which makes the overall product affordable for a wider population. The mattress and mattress component market is expanding rapidly, where the dominance of these foams is also increasing their availability in many regions. The rising investments in memory foams are also helping in providing personalized support to individuals, which will make it more popular in the coming years. The expansion of this mattress in online and retail stores is anticipated to target the suburban population for revenue growth.

The latex mattresses segment is anticipated to grow at the fastest CAGR during the forecast period of 2025 to 2034. The growing popularity of the segment is attributed to its sustainable approach, which uses eco-friendly materials in the manufacturing, making it attractive in recent years. The rising shift towards allergy-resistant mattresses is increasing its growth in the mattress and mattress component market. The emerging market companies are also targeting these segments to make an impact in their initial years.

The foam segment stood as the dominant one by contributing to the largest revenue share in 2024. The dominance of the segment is attributed to the higher demand for foams as they are used in the base layer of the mattress. As a result, the companies are investing heavily in these components to make them more durable and premium, which makes them fit for the long run. Additionally, the component is also manageable in packaging and shipping, which increases its popularity globally.

The fillings segment is observed to rise at the fastest CAGR during the forecast period of 2025 to 2034. The segment deals with the addition of fibers like cotton, wool, polyester and other materials that provide comfort to the layer. The mattress and mattress component market is expected to gain significant demand in the upcoming years due to the rising preference for advanced comfort. The rising number of luxurious homes, hotels, and hospitals is a major factor that is expected to increase the demand for these fillings in the upcoming years.

The full or double-size segment generated the highest revenue share in 2024. The dominance of the segment is attributed to the higher demand for living spaces and small rooms. The urban housing concept makes these mattresses more demanding due to the higher use of full-size beds. Additionally, the younger generations are also major contributors who use these mattresses in hostels and PGS. The companies are introducing new products which help them in targeting a wider consumer base in the developing regions.

The mid-segment marked its dominance by contributing to the highest revenue share in 2024. The dominance of the segment is attributed to the mass appeal of the price range, which helps in targeting the middle-class population. The growing awareness of enhanced comfort is playing a vital role in increasing its demand. The mattress and mattress component market is expanding rapidly due to the rising shift in urban areas, which is increasing the popularity of these mattresses. The rising availability of these mattresses in retail stores is also anticipated to make them more popular in the coming years.

The high segment is expected to emerge as the fastest-growing during the forecast period of 2025 to 2034. The rising health and wellness awareness is playing an influential role in educating the population about sleep quality and overall health. As a result, the individuals are preferring premium products, which can help them in improving their overall lifestyles. The growth of the hospitality sector is expected to drive significant revenue in future.

The residential segment accounted for a dominant share in 2024. The larger consumer base of the mattress is households and increasing apartments, making it dominant in the mattress and mattress component market. The rising global population is playing a crucial role in the rising competitive business environment, which also provides significant business opportunities for emerging companies. Additionally, the requirement for replacements is also expected to engage a larger consumer base in the coming years.

The commercial segment is anticipated to rise at the fastest CAGR during the forecast period of 2025 to 2034. The growing number of hotels and resorts is creating wider opportunities for the companies through bulk purchases. Additionally, the privatization of the hospitals is also expected to raise the demand for premium mattresses in these settings. The global rise in the tourism sector is also expected to increase the demand for mattresses in the upcoming years.

The offline segment generated the highest revenue share in 2024. The growth is influenced by the higher retail dominance in the rural and urban regions. The mattress and mattress component market is expanding rapidly due to the higher consumer volume that prefers offline shopping, due to the higher trust and reliability in the distributors. The medium also provides personal services which help in selecting the products according to their preferences. These physical stores also provide testing options, which enhance the user experience.

The online segment is anticipated to rise at the fastest CAGR during the forecast period of 2025 to 2034. The growth of the segment is influenced by the rising digital presence of global companies like Godrej, IKEA and many others, which are helping in gaining the consumer trust on these platforms. The rising e-commerce presence is also helping the urbanized areas to mark more revenue through digital shopping. Many companies are going online and providing DTC services which provide premium products at affordable prices.

April 2025

April 2025

April 2025

April 2025