April 2025

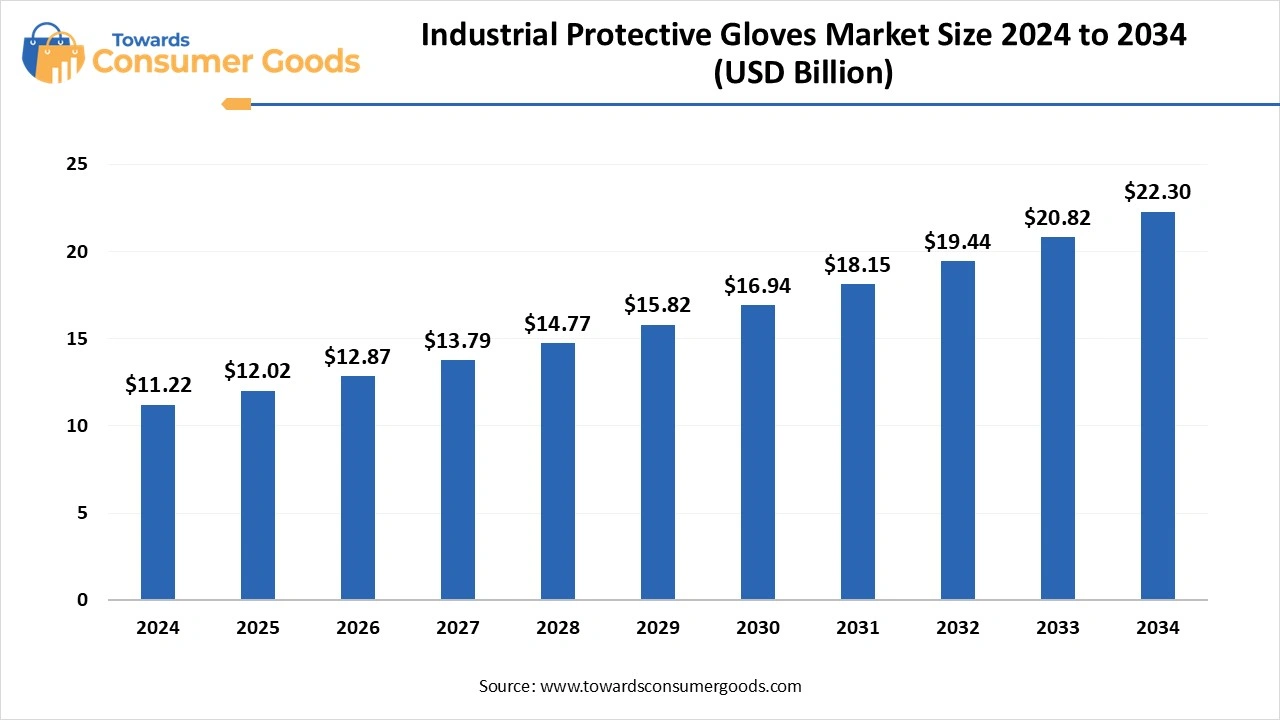

The global industrial protective gloves market size was valued at USD 11.22 billion in 2024 and is estimated to hit around USD 22.30 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.11% during the forecast period 2025 to 2034. Strict regulation ensuring suitable use of gloves and a rise in workplace accidents have driven the market growth.

The industrial protective gloves market is fundamentally centered on the critical task of safeguarding workers' hands against a diverse range of hazards they face in various industrial environments. These hazards include a variety of risks such as cuts, abrasions, punctures, chemical burns, thermal hazards, vibrations, impacts, and exposure to harmful substances. The primary objective of these gloves is to prevent injuries while also ensuring hygiene and maintaining safety across a wide array of applications.

Different industries are confronted with distinct hazards, creating an increasing demand for specialized gloves designed to mitigate these specific risks. For example, the chemical industry requires chemical-resistant gloves that can withstand exposure to corrosive substances, while the manufacturing and construction sectors often depend on cut-resistant gloves to protect against sharp objects. In welding operations, heat-resistant gloves are essential to shield workers from extreme temperatures, while sterile disposable gloves are vital in healthcare and food processing to maintain hygiene.

The industrial protective gloves market is currently experiencing robust growth, driven by the implementation of stringent workplace safety regulations. These regulations are crucial and non-negotiable, compelling employers to invest in and ensure the consistent use of appropriate industrial gloves to avoid potential penalties and to promote worker safety. Increasing awareness among both employers and employees regarding the significance of preventing hand injuries is further contributing to this growth.

Additionally, the expansion of major industries such as manufacturing, construction, oil and gas, chemicals, automotive, healthcare, and food processing directly correlates with a heightened demand for industrial gloves. Rapid industrialization and infrastructure development in emerging sectors are also spurring this demand.

| Report Attributes | Details |

| Market Size in 2025 | USD 12.02 Billion |

| Expectrd Size in 2034 | USD 22.30 Billion |

| Growth Rate | CAGR of 7.11% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | North America |

| Segment Covered | By Protective Gloves Material, By Type, By Application, By End Use Industry, By Region |

| Key Companies Profiled | Huihong (NANTONG) Safety Products Co., Ltd (China),Ansell Ltd. (Australia),Hartalega Holdings Berhad (Malaysia), Top Glove Corporation Bhd (Malaysia), 3M (U.S.) ,Superior Gloves (U.S.) ,Kossan Rubber Industries Bhd (Malaysia), Kimberly-Clark Corporation (U.S.), DIPPED PRODUCTS PLC (Sri Lanka), Globus (Shetland) Ltd. (U.K.) ,Uvex Group (Germany) ,PIP Global (U.S.), Honeywell International Inc. (U.S.) ,Showa Glove Co. (U.S.) ,Towa Corporation (Japan) ,Supermax Corporation Berhad (Malaysia) ,ATG- Intelligent Glove Solutions (Sri Lanka), Lalan Group (Pvt) Ltd (Sri Lanka), Jiangsu Hanvo Safety Product Co., Ltd. (China), QS Safety (China) |

The industrial protective gloves market is poised for substantial growth, driven by various factors. These include an accelerated pace of automation in the workplace, a heightened awareness of safety hazards, and an increase in industrial activities across sectors. As a result, manufacturers are making substantial investments in research and development (R&D), focusing on sustainability and innovative technologies aimed at improving glove performance and customization.

This shift is responding to the rising demand from industries seeking gloves that meet specific safety standards and requirements, opening avenues for manufacturers to deliver tailored protective solutions. Furthermore, there is a growing emphasis on developing eco-friendly and sustainable glove alternatives in response to environmental concerns. The disposable gloves segment, in particular, is witnessing steady growth, especially in critical industries such as food processing, pharmaceutical manufacturing, and chemical handling, where hygiene and safety are paramount.

Despite the promising outlook, several challenges could impede market growth. One significant concern is the prevalence of skin allergies associated with latex gloves, which leads to increasing scrutiny over their use. Additionally, the ongoing trend of automation across manufacturing and construction sectors is decreasing the need for manual labor, which could further reduce glove demand.

Compounding these issues are disruptions in global supply chains, the environmental impact of improper disposal methods for disposable gloves, and an overall emphasis on sustainability. The non-biodegradable nature of many disposable gloves has raised environmental alarms, creating pressure for the industry to innovate and produce more sustainable options.

When analyzing the material composition of industrial safety gloves, latex gloves maintain a dominant position in the market. Their popularity can be attributed to their superior elasticity, comfort, and effective barrier protection against a wide array of hazards. Latex gloves excel in providing excellent tactile sensitivity and dexterity, essential for tasks requiring precise manipulation.

Their cost-effectiveness and versatility, particularly in fields such as automotive and chemical manufacturing, further contribute to their widespread use. The natural elasticity of latex ensures a comfortable fit, enhancing dexterity and suitability for tasks demanding precision.

Conversely, the nitrile glove segment is emerging as the fastest-growing category within the market. This growth can be attributed to nitrile's superior chemical resistance, puncture resilience, and overall durability compared to other materials such as latex and vinyl. Nitrile gloves are especially desirable for their latex-free properties, making them an ideal choice for individuals with latex allergies, as well as for environments where chemical handling is frequent. They exhibit significantly higher puncture resistance than their latex counterparts, enhancing safety in settings where sharp objects pose a risk.

The reusable segment of the industrial protective gloves market is the leading player, driven by several compelling factors such as cost-effectiveness, environmental sustainability, and the necessity for robust protection in hazardous working environments. This reusable category is becoming increasingly appealing, especially as environmental awareness grows, prompting industries to seek sustainable alternatives that reduce waste and support eco-friendly practices.

Conversely, the disposable glove segment is currently the fastest-growing category within the industrial protective gloves market. This surge is largely due to heightened hygiene standards, particularly in sectors such as healthcare and food processing, along with their inherent cost-effectiveness. The single-use nature of these gloves not only ensures maximum hygiene but also substantially lowers the risk of cross-contamination between different tasks or patients. Furthermore, when comparing the costs, disposable gloves often present a more affordable option for numerous industries, solidifying their favorable position in the market.

Focusing on specific applications, the chemical segment stands out as the dominant force in the industrial protective gloves market, thanks to the significant hazards associated with chemical handling, rigid safety regulations, and the imperative to safeguard workers from exposure to noxious substances.

In this realm, disposable nitrile gloves have seen a rise in popularity due to their excellent resistance to a variety of chemicals, hypoallergenic characteristics, and adaptability for numerous applications. Direct contact with hazardous chemicals can lead to skin irritations, burns, and severe health complications, making effective gloves vital for worker safety.

The mechanical segment, on the other hand, is experiencing rapid growth within the industrial protective gloves market, prompted largely by the increasing necessity for hand protection in sectors such as automotive, manufacturing, and construction. Workers in these fields face numerous hazards, including cuts, abrasions, and chemical exposure, which necessitate highly durable and resistant gloves. As awareness regarding workplace safety escalates, so does the demand for effective protective equipment, highlighting the essential role gloves play in ensuring worker safety across diverse industries.

Examining end-use insights, the healthcare sector reigns supreme in the industrial protective gloves market. The extensive use of gloves in hospital settings, laboratories, and other medical facilities generates immense demand, particularly for gloves made from materials like nitrile and latex, which are favored for their protective qualities. Moreover, the healthcare industry's unwavering focus on safeguarding both patients and workers, coupled with growing concerns about healthcare-associated infections, fortifies the demand for high-quality gloves.

Meanwhile, the manufacturing segment emerges as the fastest-growing area within the industrial protective gloves market. Manufacturing processes often involve significant exposure to hazardous chemicals, sharp tools, and other risks, underscoring the critical need for industrial gloves that offer comprehensive protection for workers in this dynamic and evolving landscape.

North America stands out as the dominant region in the industrial protective gloves market, a status largely attributed to stringent safety regulations, a robust industrial base, and heightened awareness of workplace safety practices. Canada plays a pivotal role in this dynamic, significantly contributing to both the demand for and the manufacture of industrial gloves. Specifically, Canada's strong industrial landscape, especially in sectors such as mining, construction, and oil and gas, drives substantial demand for personal protective equipment (PPE), including high-quality protective gloves.

Conversely, the Asia Pacific region is recognized as the fastest-growing market for industrial protective gloves, propelled by rapid industrialization, urbanization, and an increasing awareness of workplace safety standards. In particular, India is emerging as a key player in this growth trend, with its burgeoning manufacturing sector and the implementation of stricter safety regulations. India stands out as a major driver of growth in the Asia Pacific region, evidencing a rapidly expanding manufacturing base and a strong commitment to enhancing workplace safety practices.

By Protective Gloves Material

By Protective Gloves Type

By Protective Gloves Application

By Protective Gloves End-use Industry

By Protective Gloves Regional

April 2025