April 2025

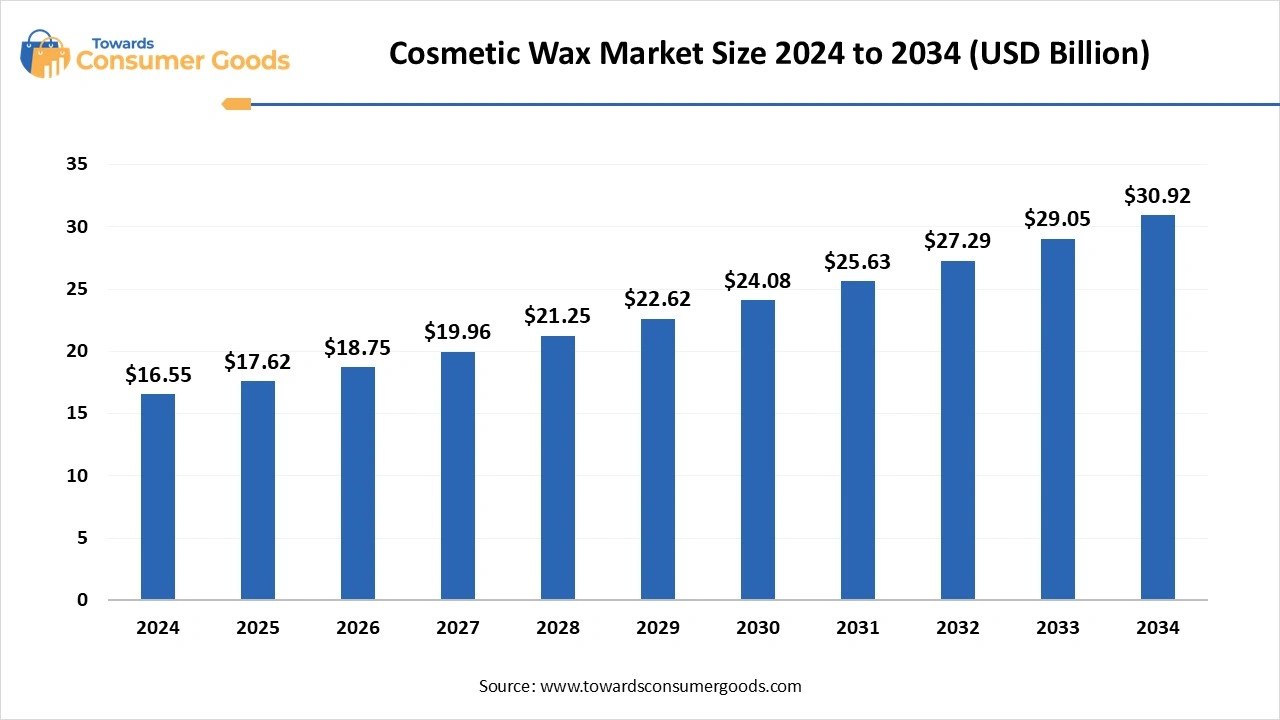

The global cosmetic wax market size was reached at USD 16.55 billion in 2024 and is estimated to surpass around USD 30.92 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.45% during the forecast period 2025 to 2034.The demand for cosmetic wax is attributed to the rising personal care trend, which attracts several consumer bases for multiple products.

Cosmetic wax refers to an organic compound which are used as a key ingredient in personal care and beauty products. These compounds play a crucial role in providing texture and stability to the products, which usually act as a thickener and emulsifier in products like lipsticks, lotions, creams, and many other products. The cosmetic wax market is growing rapidly due to the product diversification, which is raising the popularity for various waxes like bees, carnauba, candelilla, rice bran, polyethylene and many more. These ingredients are beneficial in various ways, like water resistance, longevity, gloss, and many more which play an influential role in the market growth.

The rising demand for clean beauty products is one of the major trends which is attracting a wider consumer base in recent years. Consumer preferences are mainly influenced by the rise of social media, where they are opting towards non-toxic ingredients in their products. The cosmetic wax market is growing at a rapid pace as dermatologists are also going on these platforms are promoting safe products. As a result, the companies are offering clean-label products, which highlight various tags like ‘chemical free’ to attract a significant consumer base. Additionally, the rising support from organizations like ECOCERT and the FDA is anticipated to boost the demand for these products in the coming years.

| Report Attributes | Details |

| Market Size in 2025 | USD 17.62 Billion |

| Expected Size in 2034 | USD 30.92 Billion |

| Growth Rate | CAGR of 6.45% from 2025 to 2034 |

| Base year of estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | North America |

| Segment Covered | By Type,Price,Form,Region |

| Key Companies Profile | Body Wax Brazil,CALWAX,Cirepil,Depileve,Rica Group,Starpil Wax,Tuel,Xanitalia,Dow,FILO BIANCO S.r.l.,GiGi,Italwax,Koster Keunen,LCM company,Perron Rigot, |

The changing lifestyle patterns and the rise of social media are the two major factors influencing the growth of the personal care and beauty products. The previous lifestyle was mainly based on shaving and other basic procedures, but in recent years, the demand for men's grooming products has increased where the companies are using social media platforms for marketing which is increasing the consumer base.

For example, the demand for beard grooming products is increasing where the companies are expanding their portfolio by including beard and mustache waxes. The cosmetic wax market is anticipated to a rapid pace as the salons in the urban areas are adopting the use of these products like styling waxes. Additionally, the growing adoption of men’s skincare is also anticipated to boost the demand for products like sunscreen, moisturizers, etc.

Higher product costs

The changing regulations on cosmetic products are leading towards the adoption of natural ingredients in beauty and personal products. The companies are investing in natural waxes, which are comparatively expensive to the synthetic ones, which may hamper the growth of the cosmetic wax market. Additionally, the raw material shortage can also play a restraining role as the supply chains might also witness barriers due to less demand in some regions.

North America dominated the global cosmetic wax market by generating the highest revenue share in 2024. The dominance of the region is attributed to the higher spending capacity of individuals in countries like the United States and Canada. This rising demand has been creating several business opportunities for companies that are offering premium products in the beauty care industry.

The U.S. dominance of leading companies like L’Oreal, Gamble and others is the major reason behind the growing demand in the country. The country remains dominant in the North American cosmetic wax market due to the presence of the FDA, which focuses on eliminating the use of chemical-based products. Additionally, the growing presence of direct-to-customer sales is rapidly expanding the product range in the country.

| By Region | Revenue Share 2024 (%) |

| North America | 32.85% |

| Asia Pacific | 21.45% |

| Europe | 19.95% |

| Latin America | 13.88% |

| Middle East and Affrica | 11.87% |

Asia Pacific is anticipated to emerge as the fastest-growing region during the forecast period of 2025 to 2034. The rising disposable incomes in developing countries like Japan, China and India are creating a huge business ground as the companies are targeting various populations. The presence of middle-class economies in the region is leading towards product innovation, which includes natural ingredients at an affordable price.

The cosmetic wax market in China leads the region due to the rising presence of e-commerce in the country, which is one of the dominant forces on a global level. The companies in the region are focusing on manufacturing advanced waxes that would support their economy. The Chinese population is preferring whitening products, which is helping the market grow more efficiently. Additionally, the global companies are acquiring the local brands in the country, which is anticipated to generate more product demand during the forecast period.

The natural waxes segment stood the dominant one as it generated the highest revenue share in 2024. These waxes have been marking significant demand due to their eco-friendly nature, which complies with the regulations. The cosmetic wax market is expanding rapidly, where consumers are preferring clean-label products that use natural ingredients. As a result, companies are investing in these ingredients that are helping them in engaging more audience and driving more revenue. Additionally, the rising spending capacity of individuals is anticipated to create more demand for ‘chemical-free’ products in the coming years.

The synthetic segment is projected to emerge as the fastest-growing during the forecast period of 2025 to 2034. The growing popularity of synthetic waxes is attributed to the rising use of cosmetic products among developing economies. The companies are using these waxes to make products at an affordable price, aiming to provide consumers with quality products at a cheaper price. The companies are investing heavily in these ingredients as the demand for water-resistant and durable products will rise in the coming years.

The medium segment generated the highest revenue share in 2024. The dominance of the segment is attributed to the rising popularity of midrange products, which offer enhanced texture and benefits at a reasonable price. The cosmetic wax market is expanding rapidly as the leading companies are also focusing on producing mid-range products that can target a larger consumer base in the developing regions.

Cosmetic Wax Market Share, By Price 2024 (%)

| By Price | Revenue Share 2024 (%) |

| Medium | 43.84% |

| Low | 30.97% |

| High | 25.19% |

The rising sustainability trend would also match the regulatory standards, as companies are aiming for clean-label beauty products like lipsticks, mascaras and hair styling products. The companies are targeting Gen Z and millennials by inventing a smaller-sized version of their luxurious products to gain more popularity in the affordable price segment.

The solid segment marked its dominance by generating the highest revenue share in 2024. The segment includes solid waxes like bees, paraffin, carnauba and other waxes which are used in beauty products like creams. balms, and lipsticks. The cosmetic wax market is growing rapidly as the popularity of these products is increasing in developing economies. The individuals are using these products regularly, which creates a solid business ground for the wax manufacturers. The rising use of social media is also influencing individuals towards using creams like anti-aging, skin whitening and many more, which will drive more product diversification in the coming years.

The liquid segment is anticipated to emerge as the fastest-growing region during the forecast period of 2025 to 2034. The segment includes the production of jojoba, sunflower, and other waxes, which are used in serums and lotions. The demand for the cosmetic wax market is anticipated to rise more rapidly as companies are investing in innovating natural liquid waxes. Additionally, the market is also witnessing significant demand for lightweight beauty care products like sunscreens and moisturizers, which will help in adding more revenue in the coming years.

April 2025

April 2025

April 2025

April 2025