April 2025

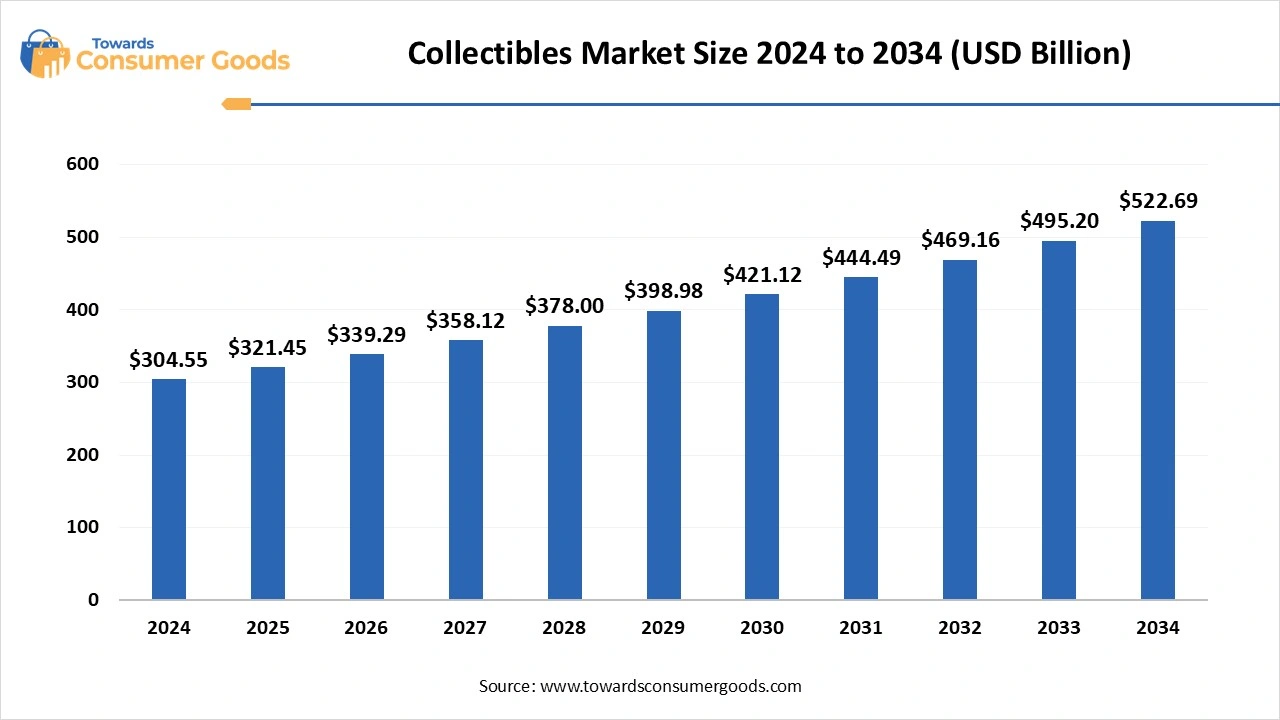

The global collectibles market size accounted for USD 304.55 billion in 2024 and is predicted to increase from USD 321.45 billion in 2025 to approximately USD 522.69 billion by 2034, expanding at a CAGR of 5.55% from 2025 to 2034. The rapid growth in digital technology and the acceptance of collectibles as valuable investments have driven the market demand.

The collectibles market encompasses the buying and selling of various items that attract collectors due to their uniqueness, cultural significance, or enhanced value over their original price tags. These collectibles can range from exquisite art pieces and rare antiques to intricate coins, vintage stamps, nostalgic toys, coveted comic books, and cherished sports memorabilia. A collectible is defined as an item whose worth significantly exceeds its initial sale price, often due to its scarcity and/or popularity among enthusiasts.

The valuation of a collectible heavily hinges on its condition and the availability of similar items in the market. Key categories within the collectible realm include fine art ranging from oil paintings to modern sculptures antiques that hold historical value, vintage toys invoking childhood memories, rare coins representing different eras, comic books that have shaped pop culture, and stamps encapsulating global histories.

Collectors devote considerable time and effort to gathering these items, often storing them in controlled environments to prevent deterioration. However, they must remain vigilant about the risks of gradual degradation or damage, which can compromise their collections over time.

The collectibles market is witnessing remarkable growth, fueled by various factors such as increasing disposable incomes, heightened interest in alternative investment strategies, the pervasive influence of pop culture and media, and technological innovations, especially online platforms that facilitate trading and connecting collectors globally.

These collectibles are increasingly regarded as tangible assets that not only enhance investment portfolios but may also act as a hedge against market fluctuations, thereby appealing to savvy investors. Among the notable types of collectibles are coins, whose historical significance and rarity can drive up their value; Stamps, which often become sought after due to limited issuance;

A notable trend in this evolving market is the rise of digital collectibles, such as Non-Fungible Tokens (NFTs), propelled by technological advancements and shifting consumer preferences. The value of collectible items is predominantly determined by factors such as rarity, condition, and provenance, which in turn fuels competitive engagement among collectors.

| Report Attributes | Details |

| Market Size in 2025 | USD 321.45 Billion |

| Expected Size in 2034 | USD 522.69 Billion |

| Growth Rate | CAGR of 5.55% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

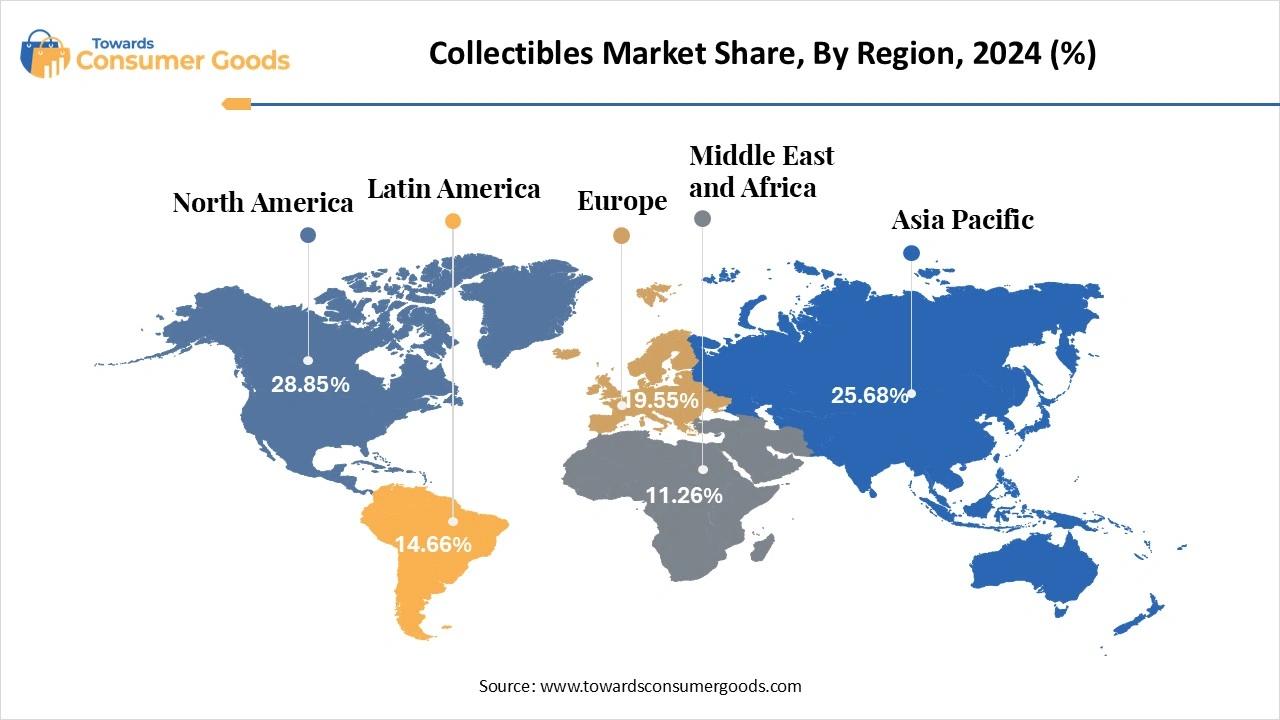

| Dominant Region | North America |

| Segment Covered | By Category, By Type, By Region |

| Key Companies Profiled | Heritage Auctions, Inc.,Funko, Inc.,Hasbro, Inc.,Christie’s International plc,Sotheby’s,Hake’s Americana & Collectibles, Inc.,Lelands, Inc.,ComicLinkCorporation,The Upper Deck Company, LLC |

Market opportunities within the collectibles sector are vast. Investors are increasingly drawn to appreciating assets, and niche markets such as digital collectibles and luxury items are flourishing. The intensifying interest in collectibles suggests that the profit potential will continue to grow, particularly if Original Equipment Manufacturers (OEMs) and ecosystem players can leverage insights from other segments dealing in vintage goods to develop innovative products and services tailored to this market. Luxury collectibles, such as high-end watches and designer handbags, are gaining recognition as viable investment opportunities.

A pivotal transformation in marketing strategies is also underway, with social media emerging as a dominant tool for promoting luxury watches. Celebrity endorsements and collaborations with influencers are replacing traditional advertising methods like print and television.

This transition to online platforms has enhanced the accessibility of luxury collectibles to a global audience, particularly appealing to the younger generation, who are digital natives and more comfortable navigating online marketplaces. This closer relationship between consumers and their collectibles is a compelling factor, particularly among younger, tech-savvy investors.

In contrast to traditional markets, which can experience drastic fluctuations, luxury investments,

such as brand-new and ultra-rare watches and handbags exhibit robust and consistent demand. This stability is largely driven by the scarcity and cultural significance of these items. The rise of Non-Fungible Tokens (NFTs) further illustrates the evolution of collectible investments.

NFTs can encompass a variety of digital assets, including artwork, music, videos, virtual real estate, and even tweets or memes. The surge in interest in digital art NFTs is particularly noteworthy, as they provide artists with innovative avenues to monetize their creativity in an ever-evolving digital landscape. Furthermore, NFTs empower artists by allowing them to embed royalties into the smart contract, ensuring they receive a percentage of future sales of their work.

Despite these exciting developments, the collectibles market does face significant challenges. Widespread counterfeiting complicates the landscape, making it difficult for collectors to find authentic pieces and reputable buyers. Additionally, the holding periods for collectibles can extend for decades before they reach peak rarity and market value. The financial implications of collecting can also be considerable, encompassing high costs related to handling, storage, transportation, marketing, and insurance, which can vary significantly based on the nature of the collectible.

Maintenance and restoration may further add to these expenses. Collectors often find themselves categorized with distinct tax implications, whether as dealers, investors, or hobbyists, each classification carrying its set of consequences. Generally, collectibles are recognized as capital assets, with any profits or losses on sale distinguished as capital gains or losses. This intricate tapestry of factors shapes the collectibles industry, presenting both opportunities and challenges for collectors and investors alike.

The art and antique segment of the collectibles market currently holds a commanding position, capturing the largest share. Furthermore, the emergence of global auction platforms and online marketplaces has greatly broadened access to these treasured collectibles, making them available to a more diverse audience. There is also an increasing desire among individuals to personalize their home decor with distinctive items, which further propels the demand for such unique artifacts.

On the other hand, the toys and action figures segment is anticipated to experience the fastest rate of growth. The allure of limited-edition releases and exclusive variants generates a heightened sense of urgency among collectors, compelling them to act quickly to secure sought-after items. Additionally, the pervasive influence of pop culture and media, especially with the release of new movies and series featuring beloved characters, significantly boosts the demand for these collectibles.

In terms of type insights, the vintage collectibles segment has emerged as a market leader, commanding the largest market share. Many collectors are driven by the desire to relive or preserve cherished memories associated with past decades. Certain rare vintage collectibles, particularly those in high demand, can appreciate dramatically in value, making them an attractive investment opportunity for discerning collectors. The proliferation of online marketplaces and auction platforms has simplified the process for enthusiasts to find, purchase, and sell vintage items, thereby expanding the market's reach significantly.

| By Type | Revenue Share 2024 (%) |

| Ancient | 24.11% |

| Vintage | 42.60% |

| Modern | 18.33% |

| Contemporary | 14.96% |

Meanwhile, the contemporary collectibles segment is projected to experience the fastest growth rate. Social media and online communities play a pivotal role in enhancing visibility and accessibility, enabling collectors to discover and acquire items with greater ease. As traditional financial markets become increasingly volatile, more consumers are turning to collectibles including contemporary art and design, as alternative investment avenues.

Geographically, North America stands as the dominant player in the collectibles market. The region benefits from a robust economy coupled with high disposable income levels, allowing a greater number of individuals to invest in valuable collectibles, whether they be rare sports cards, fine art, or other high-value objects. Events like Comic-Con, various sports events, and prominent music festivals in North America further stimulate interest and engagement within the collectibles community.

On the other hand, Asia-Pacific region is poised to emerge as the fastest-growing market for collectibles. The soaring popularity of anime, manga, and K-pop has created a substantial market for related memorabilia, including action figures, merchandise, and autographed items.

Additionally, the region's robust digital infrastructure, combined with a cultural fascination with gaming and a growing engagement in e-sports, is propelling the expansion of collectible card games in both physical and digital formats.

By Category

By Type

By Regional

April 2025

April 2025

April 2025

April 2025