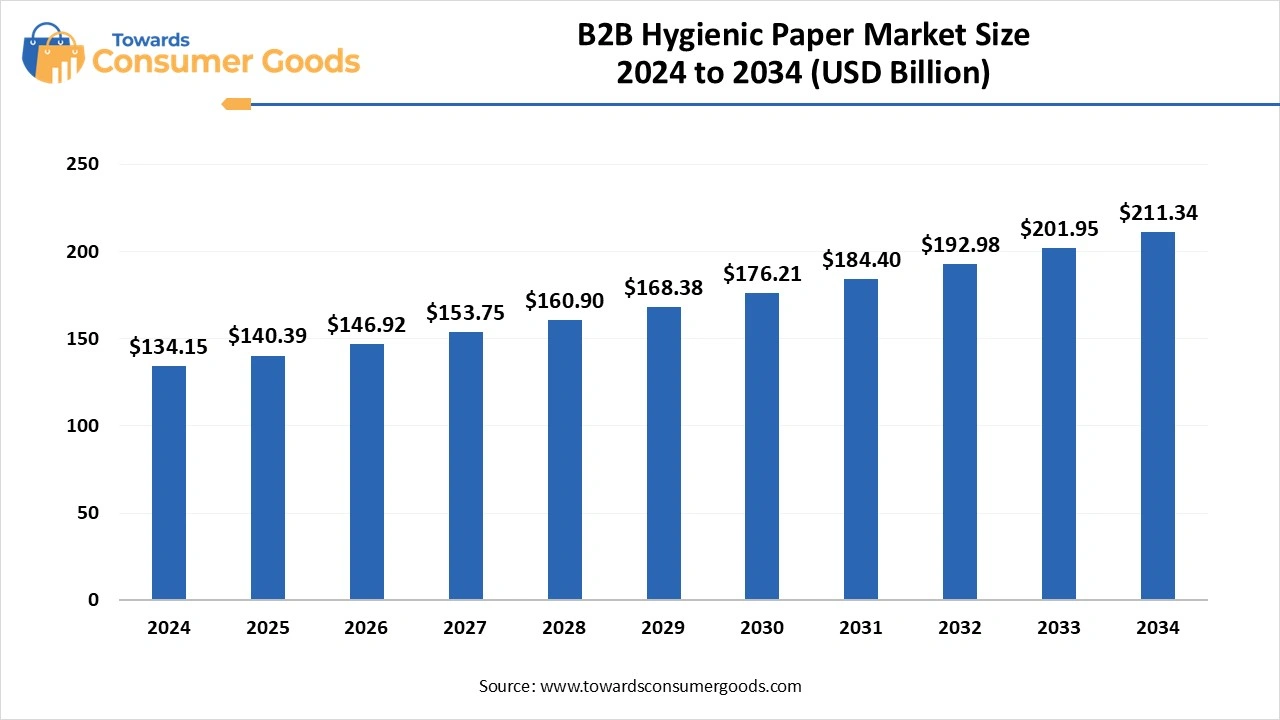

The b2b hygienic paper market size accounted for USD 134.15 billion in 2024 and is predicted to increase from USD 140.39 billion in 2025 to approximately USD 211.34 billion by 2034, expanding at a CAGR of 4.65% from 2025 to 2034. The shift toward hygiene awareness and strict regulations regarding sanitation in healthcare and food services have driven the market demand.

The foundation of the B2B hygiene paper market centers around satisfying the diverse needs of businesses and institutions for essential products such as toilet paper, paper towels, facial tissues, and industrial wipes. These items are crucial for upholding hygiene standards across a variety of settings, including restrooms, kitchens, healthcare facilities, offices, and numerous other commercial environments.

In contrast to the consumer market, where individuals typically purchase smaller quantities for personal use, the B2B sector involves substantial bulk orders. These characteristic demands highly efficient supply chains, dependable distributors, and often tailored ordering and delivery systems that cater specifically to the unique requirements of organizations.

As sustainability continues to gain traction, businesses are increasingly prioritizing eco-friendly alternatives in their purchasing decisions. This shift in consumer behavior is steering the B2B hygiene paper market towards a rising demand for products manufactured from recycled materials, sustainably sourced fibers, and items that carry recognized eco-friendly certifications.

The heightened focus on hygiene, particularly in the wake of global health concerns, emphasizes the necessity for products that help prevent the spread of infections within workplaces, healthcare environments, and public spaces. Consequently, there is an upsurge in demand for hygiene paper products like tissues, paper towels, and wipes.

Particularly within sensitive sectors such as healthcare and foodservice, stringent hygiene and sanitation regulations require the consistent use of hygiene paper products to uphold safety standards and mitigate contamination risks. As organizations strive to adopt environmentally responsible practices, the search for sustainable products intensifies.

This has led to a notable increase in demand for hygiene paper products derived from recycled materials or sustainably sourced fibers, options that not only promote environmental stewardship but also typically possess a reduced carbon footprint.

Furthermore, indirect sales channels, which encompass distributors, wholesalers, and resellers, hold a significant share of the B2B hygiene paper market. Their extensive reach and established networks play a pivotal role, particularly in regions where direct sales infrastructure may be weaker, thus facilitating broader market access and fostering overall growth.

| Report Attributes | Details |

| Market Size in 2025 | USD 140.39 Billion |

| Expected Size in 2034 | USD 211.34 Billion |

| Growth Rate | CAGR of 4.65% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | North America |

| Segment Covered | By Product, By Source, By Pricing, By End Use, By Distribution Channel, By Region |

| Key Companies Profiled | Asia Pulp & Paper (APP),Cascades,CMPC Tissue,Essity,Georgia-Pacific,Hengan International,Kimberly-Clark,Kruger,Metsa Tissue,Procter & Gamble (P&G), Renova,SCA (Svenska Cellulosa Aktiebolaget),Sofidel,The Navigator Company,WEPA |

The growing public consciousness surrounding hygiene and sanitation practices is projected to drive a surge in demand for hygiene paper products, including toilet paper, facial tissues, and paper towels. This trend is particularly pronounced in urban areas and among middle and upper-middle-class consumers who are becoming increasingly discerning about product quality and sustainability.

Businesses across various sectors are responding by adopting environmentally responsible practices, subsequently fuelling a rising demand for recycled and sustainably sourced hygiene products. The market is also transitioning towards more functional and feature-rich offerings, with an emphasis on attributes such as softness, durability, and visual appeal.

However, the B2B hygiene paper industry faces several challenges. Intensifying competition from alternative materials, such as reusable options, poses a significant constraint. Additionally, growing environmental concerns and fluctuations in raw material costs add layers of complexity to market dynamics. Improved fabric technology has rendered reusable alternatives more convenient and appealing to consumers, while the rising demand for paper products made from pulp contributes to deforestation issues.

Moreover, inadequate waste disposal methods for industry-related refuse, including medical waste, present substantial environmental challenges. The increasing adoption of bidet toilets, heralded for their hygienic and gentler cleaning capabilities, may further diminish the necessity for toilet paper.

The toilet paper segment holds a commanding position in the B2B hygiene paper market, driven by its fundamental necessity across a diverse range of sectors, including hospitality, healthcare, and public facilities.

Additionally, the rising emphasis on personal hygiene and sanitation practices, alongside the expansion of commercial spaces and the increasing population of working-class individuals, significantly bolsters toilet paper's supremacy in the B2B arena. Its ubiquitous presence in nearly all restroom facilities makes it an indispensable hygiene product across various industries.

In contrast, the facial tissue segment is witnessing the fastest growth in the B2B hygiene paper market. The demand for convenient, portable tissue options—particularly for personal hygiene, has significantly increased, thereby contributing to this segment's expansion. Facial tissues, especially those packaged in pocket-sized or travel-friendly formats, provide a practical and accessible solution for maintaining hygiene on the go.

Regarding raw materials, virgin pulp dominated the B2B hygiene paper market, owing to its exceptional quality, reliable performance, and capability to meet specific product requirements such as high absorbency and optimal whiteness.

Although recycled pulp presents ecological benefits, virgin pulp is often preferred for its ability to deliver the requisite quality and durability essential for hygiene products like tissues, toilet paper, and diapers.The recycled paper segment, however, is notably the fastest-growing area in the B2B hygiene paper landscape, influenced by an array of environmental, economic, and consumer-driven motivations.

Moreover, the cost-effectiveness of recycled paper, especially when evaluated against the long-term environmental advantages and potential government incentives, makes it an attractive option for many organizations. There is a marked shift among consumers towards environmentally friendly products, prompting a strong inclination to support those crafted from recycled sources.

From a pricing perspective, the lower end of the B2B hygiene paper market tends to dominate, largely due to the accessibility and affordability of these options. These cost-effective products are incredibly popular among organizations, especially those with extensive usage or tighter budgets, as they facilitate bulk purchasing and blend seamlessly into a variety of business environments.

The medium pricing segment, meanwhile, is experiencing rapid expansion, propelled by several influential factors. Furthermore, the rising middle class in emerging markets, along with an increasing prioritization of sustainability, has created an environment conducive to the growth of medium-priced hygiene paper products. As urban environments evolve, there is an accompanying rise in demand for convenience-oriented products, including tissue paper, that align with modern living standards.

In terms of end-use categories, the healthcare segment stands as the strongest player in the B2B hygiene paper market. This dominance is fueled by the persistent demand for hygiene products within healthcare contexts, where infection control and patient safety are critical. Hospitals, clinics, and other healthcare facilities necessitate a consistent supply of sanitation and cleaning items, prompting them to purchase hygiene paper products in bulk.

Simultaneously, the HoReCa segment encompassing hotels, restaurants, and catering services—experiences substantial growth in the B2B hygiene paper market. Key factors enabling this growth include rising disposable incomes, shifting consumer lifestyles, and an increasing preference for dining out and staying at hotels.

Additionally, the rise of corporate gatherings, conferences, and meetings further stimulates the requirement for hygiene products in business-friendly hotel and restaurant environments, thereby contributing significantly to the overall growth of the HoReCa market.

In 2024, the indirect distribution segment is anticipated to dominate the B2B hygiene paper market due to a combination of factors. These include robust demand across various sectors, such as hospitality and healthcare, the necessity for bulk purchasing, and a growing emphasis on sustainability and product quality. Indirect sales channels, encompassing distributors and wholesalers, offer a convenient and cost-effective pathway for a diverse range of businesses to access these essential products, thereby bolstering their prominence in the market.

Conversely, the direct distribution segment is projected to experience the most rapid growth rate during the forecast period. Direct sales facilitate greater oversight over product quality and delivery, fostering stronger relationships with customers while enabling quicker adjustments to changing market demands. These channels allow manufacturers to engage directly with buyers, gaining valuable insights into specific needs and preferences, thereby enhancing customer satisfaction.

In terms of regional dynamics, North America stands as the leader in the B2B hygiene paper market. This dominance is attributed to several factors, including the region's high per capita consumption rates, advanced infrastructure, and a robust commitment to hygiene and sustainable practices. Within this region, Canada, while playing a smaller role compared to the U.S., still contributes significantly to the market's overall strength. The established infrastructure ensures consistent product availability across both urban and rural areas, while consumers in North America increasingly opt for premium, eco-friendly options.

Europe, on the other hand, is witnessing rapid growth in the B2B hygiene paper domain, driven by factors such as heightened awareness around hygiene and sanitation, the expansion of the hospitality and tourism sectors, and increasing disposable incomes. France plays a pivotal role in this surge, emerging as a major producer and consumer of tissue and hygiene paper. As European economies continue to develop and disposable incomes rise, there is a greater propensity for consumers to invest in hygiene products and services.

Hygiene Plus

By Product Type

By Source

By Pricing

By End-Use Industry

By Distribution Channel

By Regional Insights